Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In the most recent “The Weekly Insight,” analyst @CryptoinsightUK locations XRP on the middle of the following market advance—mapping a five-wave construction that targets Wave 3 ≈ $6.50, Wave 4 holding > $5, and Wave 5 ≈ $9.69. The name is anchored in XRP’s relative power and a broader macro setup that he describes bluntly: “I’m bullish. I’m bullish. I’m bullish.”

Near time period, he concedes Bitcoin can nonetheless “dip within the brief time period and reclaim a number of the liquidity sitting under us,” however he argues that any shakeout precedes an aggressive upswing that ought to favor leaders like XRP.

The writer’s relative-strength case is express: “XRP has been main the way in which this cycle,” including it “is about to start its subsequent main leg greater.” He contrasts buildings: “If you overlay the Ethereum chart on prime of XRP’s, the distinction is putting… XRP… held sturdy round all-time highs… has pushed above each its earlier all-time excessive and the $2.70 swing excessive, and is now consolidating above them.

Related Reading

Meanwhile, Ethereum continues to be struggling to reclaim and maintain its all-time excessive.” He continues: “This relative power is vital… it may proceed to outperform the biggest altcoin out there,” with spot ETF hypothesis for XRP “presumably coming in September or October” and potential coverage tailwinds including gasoline.

What Needs To Happen For XRP To Hit $9.69?

Zooming out, the publication situates XRP inside a risk-on macro backdrop that would carry Bitcoin and TOTAL/Total2 and, by extension, turbo-charge altcoin management. Equities breadth is the opening bid: the S&P 500, Nasdaq, Dow Jones, and Russell 2000 are, he writes, “on the sting of or already in growth,” with month-to-month RSI in overbought traditionally previous “not less than a couple of months, and infrequently a chronic interval, of sturdy bull market exercise.” He calls it a “clear sign, a inexperienced mild for danger on.”

On cross-asset alerts, @CryptoinsightUK underscores the directional tie between Bitcoin and gold, regardless of gold’s “risk-off” label. Chinese gold demand and Western foreign money debasement, in his view, strengthen Bitcoin’s long-term case. Historically, gold bottoms have led Bitcoin bottoms by a mean ~126 days throughout 4 situations; utilized to the most recent sequence, he sketches a probabilistic Bitcoin backside window round September 15, 2025.

The liquidity map stays pivotal. On greater timeframes, he sees “extraordinarily dense” liquidity above Bitcoin, arguing that when the present vary resolves, “the transfer will doubtless be sharp and aggressive,” with a roadmap that “shortly” carries BTC towards $144,000 and past.

For alt breadth, he factors to Total2. By his analog, immediately’s construction rhymes with an “orange circle” precursor from final cycle; from that time to the height, alts rallied about 350% (technically ~366%). A repeat implies ~$7.73 trillion for Total2—an surroundings through which “XRP might be one of many clear leaders within the subsequent leg of this market cycle,” offered Bitcoin prints new highs and Total2 breaks out.

Related Reading

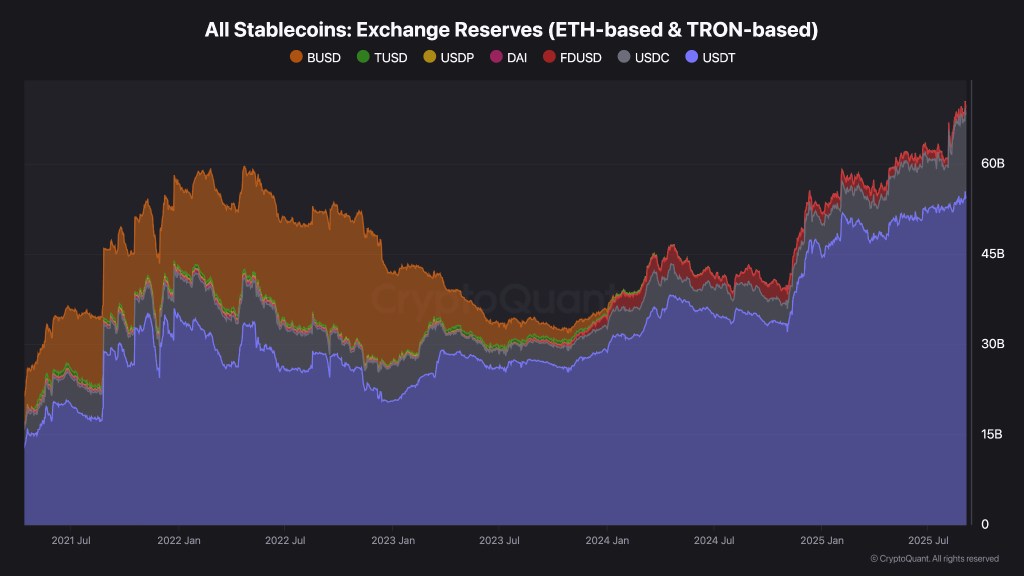

The companion “Charts of the Week” (by @thecryptomann1) sharpen the market’s near-term complexion and the way it could channel into XRP. Stablecoin alternate reserves (ETH- and Tron-based) sit at all-time highs—~$66 billion (≈ $53B USDT, $13B USDC), a cache of “dry powder” that would chase upside on a breakout or cushion a remaining dip towards ~$105,000 on BTC earlier than reversing.

A warning flag: the 30-day change in mixture whale holdings has “dropped off a cliff” just lately—“alarming,” he notes, and to not be ignored even when it doesn’t spell catastrophe. Meanwhile, NUPL (Net Unrealized Profit/Loss) has been sliding because the market “takes again” earnings from the previous ten months; a revisit of the “yellow zone” (<~0.5) may catalyze the following parabolic section. Structurally, the realized worth bands are but to tag their higher certain, supporting a cycle view that BTC surpasses $200,000 earlier than the run is finished.

Within that mosaic, XRP’s wave rely and management profile are the through-line. The projected path—Wave 3 to ~$6.5, Wave 4 holding above $5, Wave 5 extending to ~$9.69—is introduced because the high-conviction roadmap if Bitcoin’s remaining shakeout resolves greater, Total2 breaks to new cycle highs, and ETF/coverage catalysts hold skewing flows towards XRP. To the writer, these items add as much as a market the place “any pullback is a shopping for alternative,” and the place the trail of least resistance—as soon as the vary resolves—is greater, with XRP positioned to guide.

At press time XRP traded at $2.975.

Featured picture created with DALL.E, chart from TradingView.com