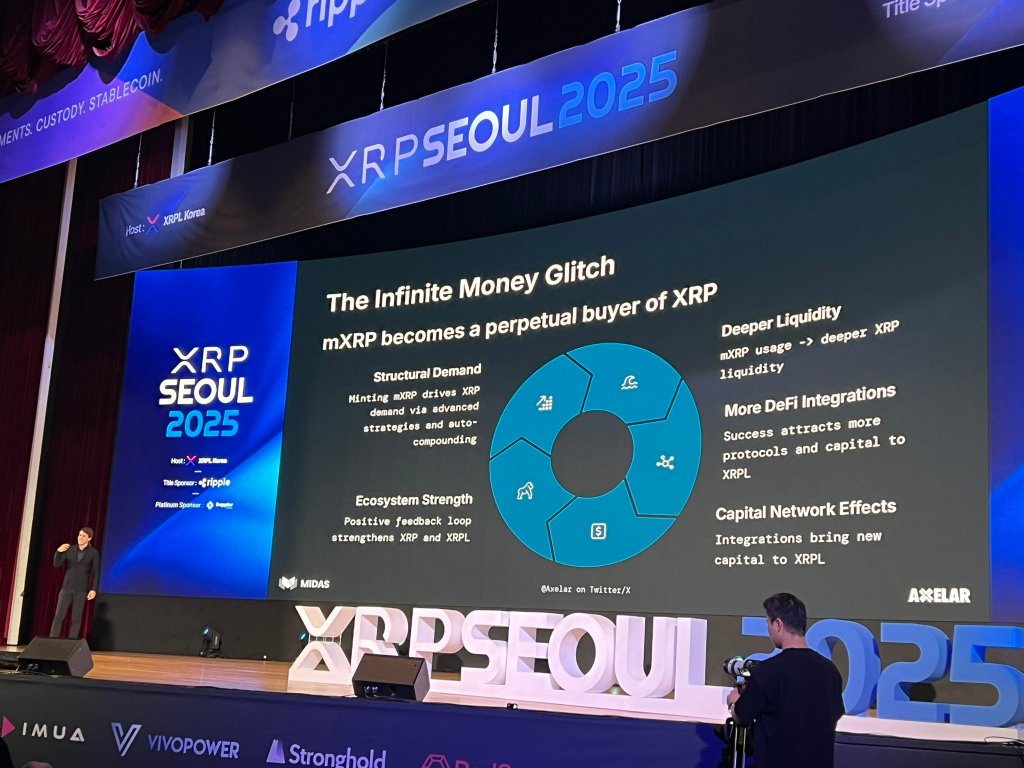

Axelar used the XRP Seoul 2025 stage on September 21 to tease what promoters framed as an “infinite shopping for energy” flywheel for XRP, centered on a brand new yield-bearing token known as mXRP that’s designed to grow to be a structural, programmatic purchaser of the underlying asset. The pitch—splashed throughout slides with “The Infinite Money Glitch” tagline—sketched a closed-loop system: minting mXRP would drive XRP purchases, feed auto-compounding methods, deepen liquidity on XRPL, and entice extra DeFi integrations and capital to the community.

In the run-up to the occasion, Axelar signaled the course of journey: “A brand new yield-bearing XRP product is launching, powered by Axelar and the main EU-regulated tokenization platform. If you’re a giant holder of XRP, full the shape under to specific curiosity,” the venture posted on September 10. On Saturday, the DeFi Business Development (BD) Lead at Axelar Leo Wu summarized the stage message extra bluntly: “gmXRP @axelar + @MidasRWA — Infinite shopping for energy for XRP,” alongside images of the slide deck.

Early reactions contained in the XRP neighborhood homed in on the promised carry. “mXRP will probably be the largest catalyst this quarter to drive important adoption and exercise on XRPL. 10% APY on XRP by DeFi yield and by simply holding mXRP is huge,” wrote Panos Mekras (co-founder & CEO at Anodos Labs) by way of X.

He added that an XRP/mXRP liquidity pool might rapidly dominate XRPL volumes and that LPs would “just about have zero threat and near-zero impermanent loss,” whereas incomes from charges and yield. While these expectations are promotional and unproven, they seize the tenor of sentiment across the launch.

What mXRP Is—And How Axelar And Midas Fit

Based on supplies shared publicly, mXRP is offered as a liquid, yield-bearing illustration of deposited XRP. Users would deposit XRP and obtain mXRP; the mXRP’s worth accretes from the methods run on the pooled collateral.

Event notes circulating on X attribute the product structuring to Midas (a European tokenization platform) and the cross-chain plumbing to Axelar, with a Korean digital-asset supervisor answerable for working methods on the again finish. The slide language emphasizes “superior methods and auto-compounding,” and frames mXRP as a “perpetual purchaser of XRP” that bolsters XRPL liquidity and “ecosystem energy.” These specifics come from the convention stage and social-media reporting; formal documentation has not but been printed.

Axelar’s function within the stack is in line with its broader integration work on XRPL this 12 months. In June, Axelar introduced it had delivered the primary cross-chain connectivity for the XRP Ledger EVM Sidechain, enabling wrapped XRP as native gasoline and wiring XRPL into greater than 80 networks and cross-chain apps by way of Squid. The firm has additionally highlighted “Earn yield onchain… begin with XRP and Stellar” in its public messaging—context that helps clarify how a yield-bearing XRP wrapper might supply liquidity and technique execution throughout venues.

Midas, for its half, has been rolling out “Liquid Yield Tokens” backed by baskets of DeFi fund methods in 2025—an adjoining template that gives a reference level for the way tokenized claim-on-yield devices will be structured underneath EU oversight. The mXRP wrapper seems to use that tokenization logic to XRP collateral particularly, with Axelar offering the cross-chain rails.

The core thought behind “infinite shopping for energy” is easy: demand to mint mXRP programmatically purchases XRP as base collateral; compounding yields develop the collateral base over time; and integrations that require mXRP/XRP liquidity create extra, recurring order circulation.

Advocates argue that this creates a constructive suggestions loop by which “mXRP utilization → deeper XRP liquidity,” and extra liquidity invitations extra integrations, which in flip brings extra capital on-chain. “The Infinite Money Glitch… with @MidasRWA mXRP that turns into a ‘perpetual purchaser of $XRP,’” one extensively shared abstract learn.

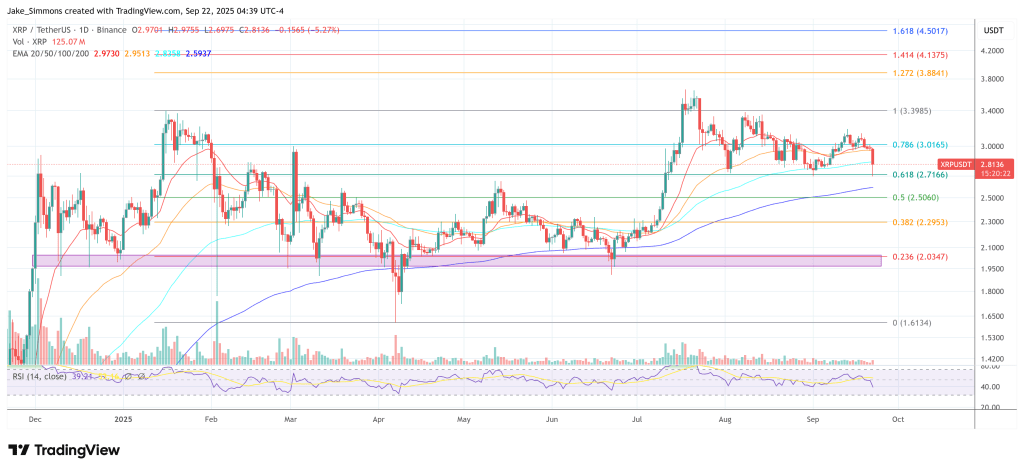

At press time, XRP traded at $2.81.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.