Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Capriole founder Charles Edwards argues that Bitcoin’s well-known four-year boom-and-bust sample has successfully ended—not as a result of markets have matured right into a placid equilibrium, however as a result of the engine that when compelled 80–90% drawdowns has been dismantled by Bitcoin’s personal financial design.

The 4-Year Bitcoin Cycle Is Dead

In his Update #66 e-newsletter revealed on August 15, 2025, Edwards writes that for the reason that April 2024 halving, Bitcoin’s annual provide development has fallen to roughly 0.8%, “lower than half of Gold’s 1.5–3%,” including that this shift “made Bitcoin the toughest asset identified to man, with look-ahead certainty.” With miners’ new-issuance provide now a rounding error in contrast with mixture demand, the dramatic, miner-driven busts of prior cycles look more and more like artifacts of an earlier period. “In quick – the first driving power behind Bitcoin cycle 80-90% drawdowns traditionally is lifeless.”

Edwards doesn’t deny that cycles exist. He reframes their causes. Reflexive investor habits, macro liquidity, on-chain valuation extremes, and derivatives-market “euphoria” can nonetheless mix to provide sizable drawdowns. But if the halving calendar not dictates these inflection factors, traders should recalibrate the alerts they monitor and the timelines on which they count on danger to crystalize.

Related Reading

On reflexivity, he cautions that perception within the four-year script can itself grow to be a worth driver. If “sufficient Bitcoiners consider within the 4 yr cycle… they’ll construction their investing actions round it,” he notes, invoking George Soros’s notion that market narratives feed again into fundamentals. That self-fulfilling factor can nonetheless set off “sizeable drawdowns,” even when miners are not the marginal price-setters.

Macro liquidity, in Edwards’s framework, stays decisive. He tracks a “Net Liquidity” gauge—the year-over-year development in world broad cash minus the price of debt (proxied by US 10-year Treasury yields)—to tell apart genuinely expansive regimes from nominal cash development that’s offset by increased charges.

Historically, “All of Bitcoin’s historic bear markets have occurred whereas this metric was declining… with the depths… whereas this metric was lower than zero,” he writes, whereas “All of Bitcoin’s main bull runs have occurred in optimistic Net Liquidity environments.” As of mid-August, he characterizes circumstances as constructive: “We are at the moment in a optimistic liquidity setting and the Fed is now forecast to chop charges 3 occasions within the the rest of 2025.”

On-Chain Data Is Still Supportive

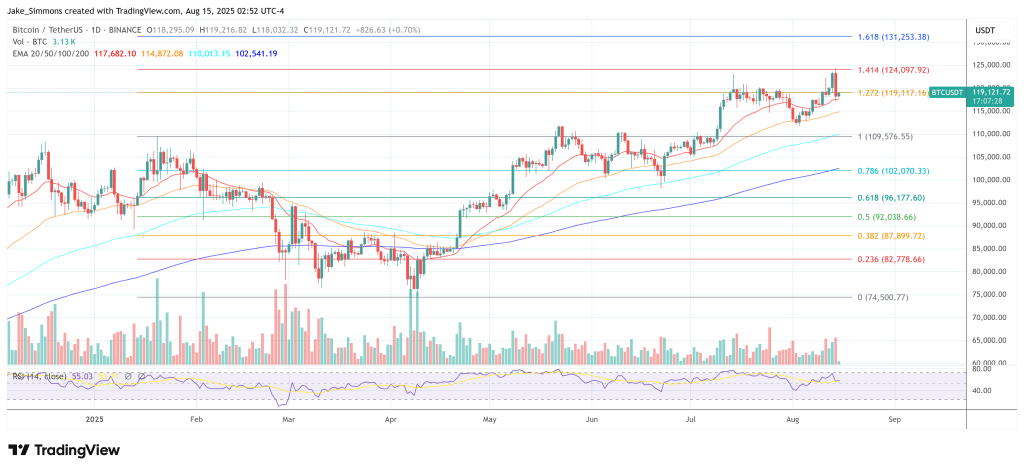

If liquidity units the tide, euphoria marks the froth. Edwards factors to established on-chain gauges—MVRV, NVT, Energy Value—which have traditionally flashed crimson at cycle peaks. Those indicators, he says, aren’t but there: “In 2025 we nonetheless see no indicators of onchain Euphoria. Bitcoin right this moment is appreciating in a gentle, comparatively sustainable means versus historic cycles.”

A chart of MVRV Z-Score “reveals we’re nowhere close to the worth euphoria of historic Bitcoin tops.” By distinction, his derivatives composite—the “Heater,” which aggregates positioning and leverage throughout perps, futures, and choices—has been sizzling sufficient to warrant short-term warning. “The warmth is on… Of all of the metrics we’ll have a look at right here, this one is telling us that the market regionally has overheated close to all time highs this week.” In his telling, elevated Heater readings can cap near-term upside except they persist for months alongside rising open curiosity—circumstances extra according to a significant high.

One metric, nevertheless, eclipses the remainder in 2025–26: institutional absorption of latest provide. “Today, 150+ public corporations and ETFs are shopping for over 500% of Bitcoin’s day by day provide creation from mining,” Edwards writes. “When demand outruns provide like this, Bitcoin has traditionally surged over the approaching months. Every time this has occurred in Bitcoin’s historical past (5 occurrences), worth has shot up by 135% on common.” He emphasizes that the present, prolonged interval of excessive multiples on this measure is “excellent news for Bitcoin,” whereas conceding the plain caveat: nobody can know the way lengthy such circumstances will final.

Related Reading

Because institutional demand can flip to produce, Edwards particulars a “treasury firm early warning system.” He highlights 4 watch-items that his workforce tracks “24/7 for cycle danger administration and positioning functions”: a Treasury Buy-Sell Ratio that, if falling, “suggests rising promoting by the 150+ corporations”; a Treasury CVD whose flattening or lurch right into a “crimson zone” is “danger off”; the share of Coinbase quantity that’s internet shopping for; and a Treasury Company Seller Count that, on spikes, has traditionally preceded stress.

Layered on high is balance-sheet fragility. The extra treasuries lever as much as accumulate Bitcoin, the extra a drawdown can cascade by way of compelled deleveraging. “Total Debt relative to Enterprise worth are key to trace,” he says, including that Capriole will publish a recent tranche of treasury-risk metrics “subsequent week.”

Quantum Computers Vs. Bitcoin

Edwards then makes an argument many Bitcoin traders will discover uncomfortable: quantum computing is each a pretty return alternative and Bitcoin’s most concrete long-term tail danger. Capriole, he says, expects “the asset class will outperform Bitcoin by circa 50% p.a. over the subsequent 5–10 years,” citing right this moment’s small market capitalizations towards a “$2T+” addressable market.

At the identical time, “within the long-term (with out change) QC is existential to Bitcoin,” with a worst-case window of “3–6 years” to interrupt the cryptography that secures wallets and transactions. He notes that China “is spending 5X extra on QC than the US” and lately “introduced a QC machine one million occasions extra highly effective than Google’s,” arguing that the tempo of breakthroughs, “with… improvements occurring each quarter,” suggests “this expertise will mature prior to many assume. Just like ChatGPT.”

The operational problem, even when the danger will not be imminent, is the migration path. Edwards sketches back-of-the-envelope constraints: roughly 25 million Bitcoin addresses maintain greater than $100; on “ day,” the community handles about 10 transactions per second. If everybody tried to rotate to quantum-resistant keys without delay—and lots of would prudently ship check transactions—it will take “3–6 months” simply to push the transactions by way of, earlier than even counting the time to attain consensus on, and deploy, a most popular improve. “Optimistically we’re taking a look at a 12 month lead time to maneuver the Bitcoin community to a Quantum proof system,” he writes. He flags work by Jameson Lopp as a place to begin and urges the neighborhood to “encourage motion on the QC Bitcoin Improvement Proposals (BIPS).” Capriole itself holds quantum-computing publicity each for return potential and as “a portfolio hedge ought to a worst case state of affairs eventuate.”

His conclusion is evident with out being complacent. “The Bitcoin miner pushed cycle is essentially lifeless.” If institutional demand holds, “there’s a sturdy probability of a proper translated cycle,” with “a major interval of worth enlargement nonetheless forward of us.” But vigilance is crucial.

The two variables to prioritize this halving epoch, in his view, are “Net Liquidity and Institutional Buying,” whereas the “largest danger to this cycle” is paradoxically the cohort that has powered it: the Bitcoin treasury corporations whose balance-sheet decisions can compound each upside and draw back. Quantum computing, he stresses, “isn’t a danger to Bitcoin this Halving cycle,” however absent motion “it actually can be within the subsequent one.” The prescription is to not concern cycles, however to retire the outdated ones and put together—technically and operationally—for the cycles that stay.

At press time, BTC traded at $119,121.

Featured picture created with DALL.E, chart from TradingView.com