Solana is holding its dominance in decentralized finance with a hanging efficiency in July. Reports point out that DEX exercise on its community hit $124 billion throughout the month, extending a profitable streak towards Ethereum to 10 straight months. Analysts say this provides Solana a 40% edge over its rival on this phase, signaling a transparent shift in person conduct.

Related Reading

Shift To Solana Picks Up Speed

Reports have disclosed a pointy rise in new tasks selecting Solana. Alliance DAO knowledge present that greater than 40% of founders within the first half of 2025 picked Solana, up from 25% a 12 months earlier.

That change is being linked to Solana’s potential to run massive numbers of transactions shortly and at low value, which makes it engaging to groups constructing performance-focused DeFi apps.

This week in knowledge by @SolanaGround:

Solana outpaced Ethereum in DEX buying and selling quantity for the tenth consecutive month, reaching $124B in July, 42% greater than Ethereum. pic.twitter.com/TT0nb8wrtm

— Solana (@solana) August 23, 2025

Developers say they need pace and predictable charges. Solana provides each. The transfer by creators shouldn’t be trivial; it reshapes the place new liquidity and smart-contract work will get constructed.

Solana’s DEX volumes haven’t simply grown; they’ve been sustained. For 10 straight months Solana has outpaced Ethereum on that metric.

That streak is uncommon. It reveals buying and selling exercise and automatic market makers on Solana are busy. Onlookers level out that greater DEX throughput can draw extra customers, and extra customers can carry extra builders. A suggestions loop can kind.

Technical Signals

Based on experiences, SOL is buying and selling above the $205 zone after a current breakout. The 20-day SMA sits close to $191 and is being watched as short-term assist.

Market indicators are cited as constructive. The MACD is exhibiting inexperienced motion bars, which some merchants interpret as upward momentum.

$SOL is on a one-way ticket to the moon. 🚀 After a brutal drop, Solana has discovered its footing and is driving an ideal uptrend channel. The path to $300 is vast open pic.twitter.com/vR4HdL272O

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) August 24, 2025

Analysts have set close by resistance factors at $215, $228, and $240. Kamran Asghar is amongst these forecasting a longer-term goal of $300 if present traits persist.

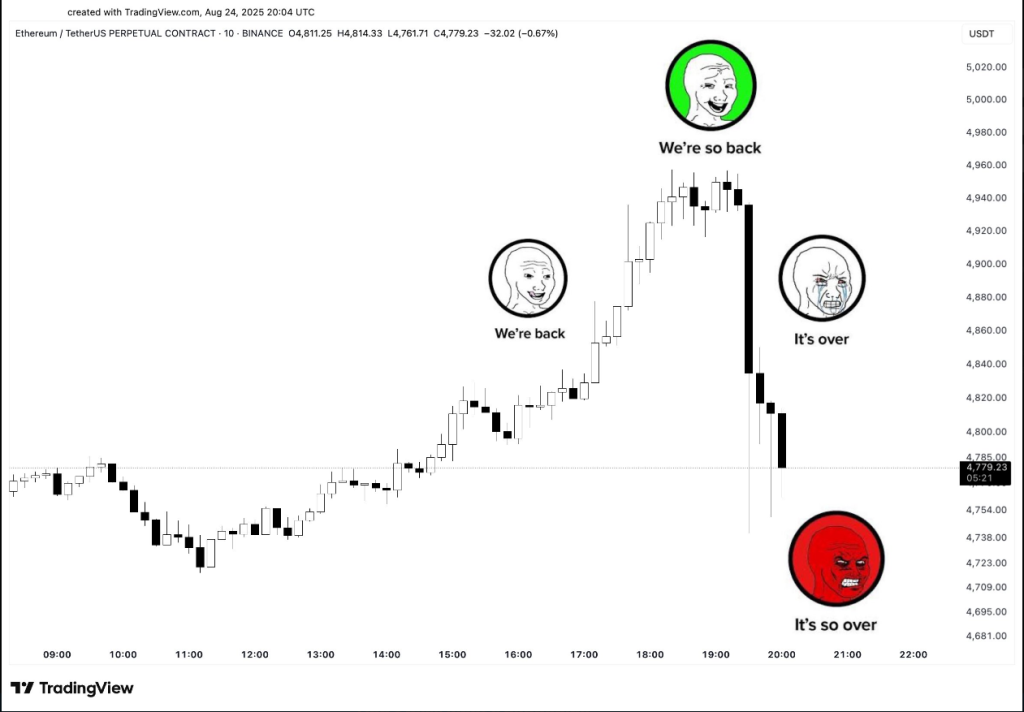

At the identical time, Ethereum has been unstable: it fell beneath $4,800 and briefly swung from about $4,940 right down to underneath $4,720 inside hours, a transfer that underscored how uneven markets stay. This was echoed by crypto analyst Ali on X, suggesting his bearish opinion because the market modified in sentiment.

IT’S SO OVER! $ETH pic.twitter.com/atcQbHhMJi

— Ali (@ali_charts) August 24, 2025

Related Reading

Solana’s beneficial properties are taking place whereas Ethereum handles continued institutional demand and holds management in different measures.

That distinction suggests the market is fragmenting in the place several types of exercise focus — DEX quantity on one chain, institutional flows on one other.

The shift of latest tasks towards Solana is being framed as a sensible response to throughput limits relatively than as a wholesale rejection of Ethereum.

Featured picture from Equiti, chart from TradingView