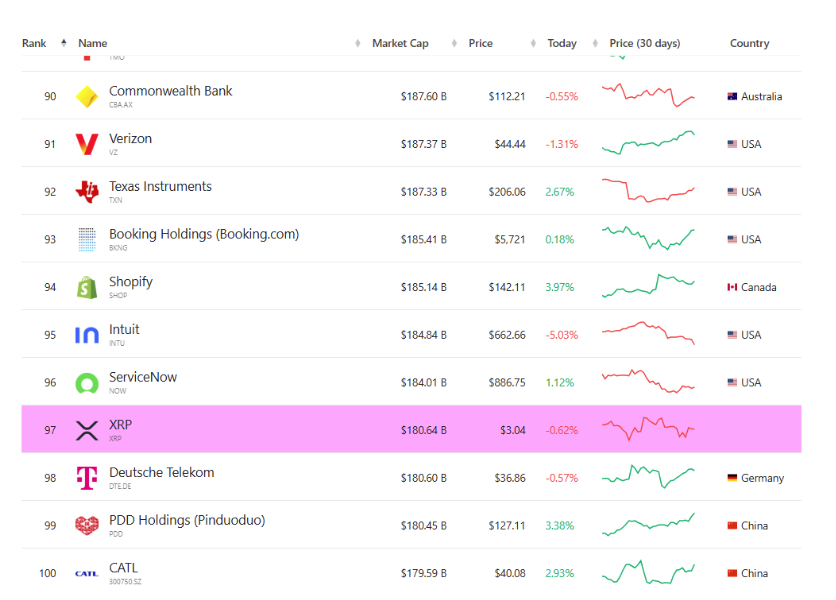

Ripple’s XRP has formally damaged into the highest 100 international property by market capitalization, a milestone that locations it alongside a number of the world’s most dear corporations like Shopify, Intuit, and Deutsche Telekom.

According to the newest information, XRP holds a market cap of round $181.2 billion at a worth of $3.02 per token, rating it above a centesimal on the worldwide leaderboard. More notably, XRP has managed to hitch this unique listing with out the backing of a regulated spot ETF within the United States, in contrast to its crypto counterparts Bitcoin and Ethereum, that are additionally on the listing of the biggest international property.

Related Reading

XRP Joins The Rank Of World’s Top Assets

At the time of writing, XRP is the 97th largest asset by market cap, the third cryptocurrency within the listing behind Bitcoin at seventh and Ethereum at twenty second. XRP’s climb to this milestone might be traced to a wave of inflows which have been pouring into the asset in current months. The scale of those inflows has been sufficient to push XRP’s market cap above BNB and stablecoin Tether USDT, making it the third-largest cryptocurrency by market capitalization.

Institutional and retail buyers have been drawn to XRP following the conclusion of its authorized battle with the US Securities and Exchange Commission. This confidence, mixed with the bigger crypto market bullishness, has seen the XRP worth set up a brand new assist base at $3.

Crossing into the ranks of the world’s high 100 property reveals how XRP is faring in comparison with corporations outdoors the cryptocurrency market. At its present valuation, XRP is now on the tails of a number of the most acknowledged international companies, like Verizon, Texas Instruments, Shopify, and Intuit.

Top property by market cap: CorporationsMarketCap

The Case For More Growth With A Spot XRP ETF

Bitcoin and Ethereum have gained great institutional traction up to now 18 months or so by way of the launch of regulated spot ETFs within the United States. XRP, then again, has reached its present standing with out such an instrument. Therefore, XRP’s current milestone could also be simply the begin of a a lot bigger climb.

The absence of ETF-driven inflows signifies that XRP has vital untapped potential ready to be unlocked by way of monetary establishments like BlackRock, Fidelity, and Grayscale as soon as regulatory approval for a Spot XRP ETF arrives within the US. Such a buying and selling instrument would open the door for large-scale institutional buyers who’ve up to now been restricted in accessing XRP publicity.

Related Reading

If the identical influx patterns seen in Bitcoin and Ethereum ETFs are seen once more with XRP, its market capitalization might simply push previous its present friends within the high 100 international asset rankings alongside its worth.

At the time of writing, XRP is buying and selling at $3.04. Expectations tied to the eventual approval of Spot XRP ETFs stretch from reasonable projections of $4 to formidable forecasts of as excessive as $1,000.

Featured picture from Unsplash, chart from TradingView