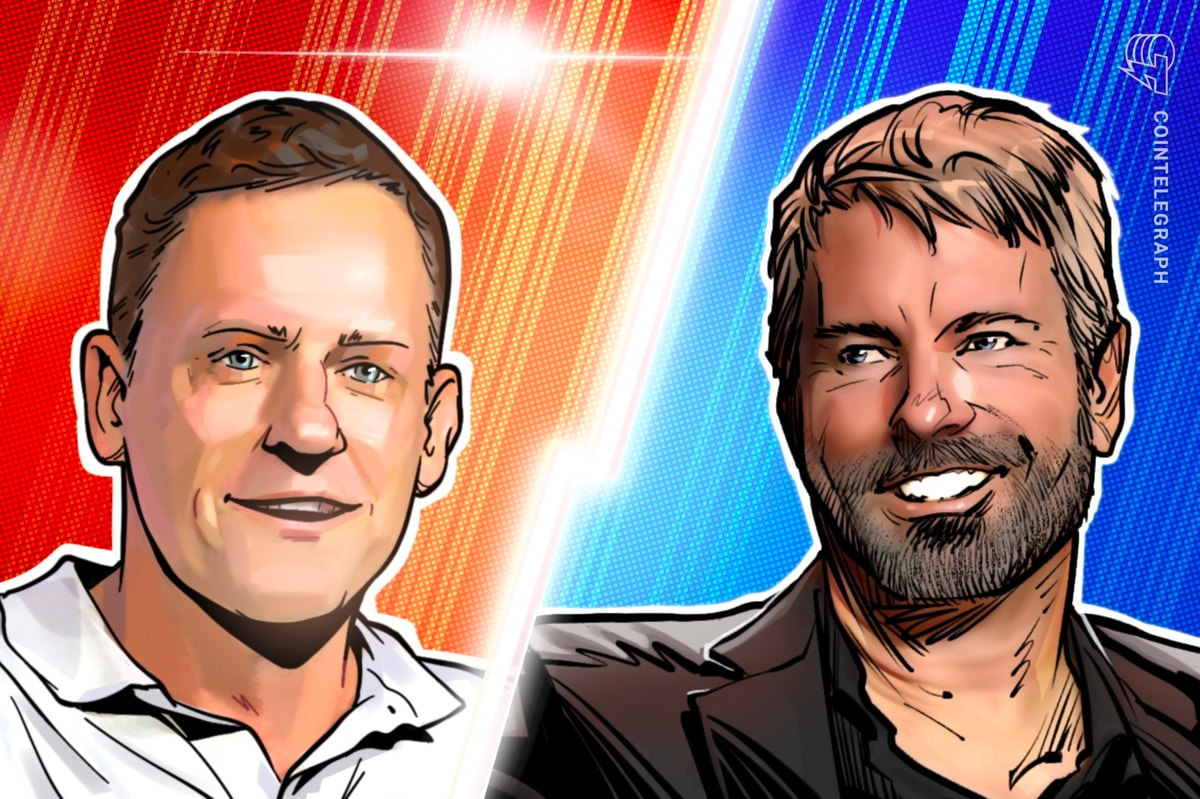

Tech billionaires Peter Thiel and Michael Saylor are establishing crypto firm treasuries, however some monetary observers notice that their methods may pose important threat.

Both Thiel and Saylor have poured substantial capital into cryptocurrencies by their respective corporations and funding autos: Saylor, together with his software program agency Strategy’s frequent Bitcoin (BTC) buys, and Thiel, by enterprise capital investments in crypto corporations, and his trade, Bullish, which went public earlier in August.

Each is just not solely searching for to increase his holdings but in addition how the cryptocurrency trade is formed and controlled. But there are nonetheless important variations of their respective methods and outlooks concerning crypto, and firms that determined to kind crypto treasuries could possibly be inviting a “dying spiral” when costs crash.

Thiel and Saylor have differing crypto funding methods

Michael Saylor, co-founder and chairman of software program firm Strategy (previously MicroStrategy), has created waves within the monetary world by what has been dubbed an “infinite cash glitch.”

The “glitch” refers to Strategy’s method to purchasing Bitcoin, whereby it points inventory or equity-linked securities to purchase Bitcoin after which holds the asset on its steadiness sheet.

Normally, issuing extra fairness would devalue the inventory’s value, however massive Bitcoin purchases improve BTC’s value, subsequently growing Strategy’s valuation and permitting it to concern extra debt.

And the cycle continues.

The technique has been so profitable for Strategy that it has gained a number of imitators. The time period “Bitcoin treasury firm” is rising more and more frequent within the monetary world, with 174 public firms reportedly holding Bitcoin, based on BitcoinTreasurys.web.

Saylor’s crypto technique concentrates solely on Bitcoin, specifically, accumulating the biggest portion of the cryptocurrency as attainable, and comprises an almost metaphysical characterization of the asset.

In 2020, he wrote that Bitcoin “is a swarm of cyber hornets serving the goddess of knowledge, feeding on the fireplace of reality, exponentially rising ever smarter, sooner, and stronger behind a wall of encrypted power.”

In a speech on the Bitcoin Policy Institute in March, Saylor stated Bitcoin was a “Newtonian community,” the management of which was essential for the US to keep up world energy.

He additional advised that an aggressive Bitcoin accumulation technique from the US authorities may erase the nationwide debt and advised in different interviews {that a} nationwide Bitcoin reserve is “manifest future for the United States.”

Thiel’s technique, whereas much less groundbreaking, is extra various. In February 2025, Founders Fund, a VC agency co-founded by Peter Thiel in 2005, which backed corporations like SpaceX, Palantir and Facebook, invested $100 million in Bitcoin and one other $100 million in Ether (ETH).

Which crypto funding technique will show simpler in the long term:

A) Michael Saylor’s Bitcoin-only method

B) Peter Thiel’s diversified techniqueShare your ideas within the feedback 👇👇👇

— Cointelegraph (@Cointelegraph) August 26, 2025

The Founders Fund owns 7.5% of ETHZilla, a biotech agency that remodeled into an Ether funding car, in addition to a 9.1% share in BitMine Immersion Technologies, which Founders Fund helped increase $250 million in ETH.

Thiel has additionally backed a cryptocurrency trade, Bullish, that went public on Aug. 19, receiving a $1.15-billion valuation settled throughout a number of stablecoins, together with USDC (USDC) and PayPal USD (PYUSD).

He is clearly invested within the crypto area and is optimistic about its development, however Thiel has additionally proven some extra measured skepticism, significantly concerning Bitcoin. Far from Saylor’s “swarm of cyber hornets serving the goddess of knowledge,” Thiel beforehand questioned whether or not the asset isn’t not less than “partially a Chinese monetary weapon towards the US.”

“It threatens fiat cash, but it surely particularly threatens the US greenback, and China needs to do issues to weaken it so China is lengthy Bitcoin, and from a geopolitical perspective, the US ought to be asking some more durable questions on precisely how that works.”

In quick, Thiel’s method presents a extra cautious and diversified publicity to cryptocurrencies, whereas Saylor takes an aggressive, direct publicity, all-in-on-Bitcoin technique.

Bitcoin treasury firms on the rise: Is it a bubble?

The crypto trade might quickly discover out which technique will win. In current weeks, the Bitcoin treasury mannequin championed by Saylor has been shedding steam.

The mannequin’s thesis of “increase capital, convert to Bitcoin and look forward to appreciation” could also be pretty simple, but it surely leaves the corporate weak to the infamous volatility of Bitcoin markets.

If the worth of BTC dips too near the Bitcoin-per-share metric, or web asset worth (NAV), of an organization’s inventory, that inventory loses the valuation buffer that was speculated to carry its inventory value.

This can result in a supposed “dying spiral” through which, as an organization’s market cap shrinks, so does its entry to capital. Without anybody to purchase the corporate’s fairness or any lenders, the agency can not increase its holdings or refinance current debt. Should a mortgage mature or a margin name come, compelled liquidations will observe.

Strategy’s NAV presently clocks in at 1.4 instances its share value. It was almost double the share value in February, when Carnegie Mellon University finance professor Bryan Routledge instructed Fortune, “There’s no rational rationalization for that distinction.”

Strategy buyers, due to this fact, face threat not solely from fluctuations in Bitcoin’s value however from “no matter is driving this distinction between the web asset worth and the worth of the shares … That additional element is an additional supply of threat.”

In current weeks, the Strategy inventory value has slumped together with BTC, however Saylor’s BTC-buying runs proceed unabated. The firm purchased 3,081 BTC for $356.9 million over the week ending Aug. 24.

Market circumstances could also be comparatively regular for now, and coverage from the White House stays firmly pro-crypto. But crypto winters at all times come, and after they do, the market will see which technique survives.

Magazine: The one factor these 6 world crypto hubs all have in frequent…