Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The query reverberating throughout —whether or not a decisive break under $105,000 would finish the Bitcoin bull cycle—drew a crisp rebuttal from well-liked market analyst CrediBULL Crypto (@CredibleCrypto). In a pair of late-night posts to his 476,000 followers, he argued that whereas $105,000 is a key threshold for the “most aggressive” upside path, a lack of that stage wouldn’t, by itself, terminate the higher-time-frame uptrend.

“No, if $105,000 is misplaced it’s not ‘over’ it simply means probably the most aggressive/bullish state of affairs is out of play and a deeper correction is much more seemingly,” he wrote. “HTF construction isn’t damaged till/until $74,000 is misplaced—all defined in my final Youtube vid so earlier than you ask ‘why so low for HTF invalidation’ go watch the vid :).”

In a second submit he reiterated the pivot that has framed his outlook for weeks: “$107-$110,000 has at all times been the MOST pivotal level on the BTC chart… This is the almost certainly zone for a full on reversal—it doesn’t imply it’s assured in fact however that is the final place it is smart to begin flipping bearish.”

How Low Could Bitcoin Price Go?

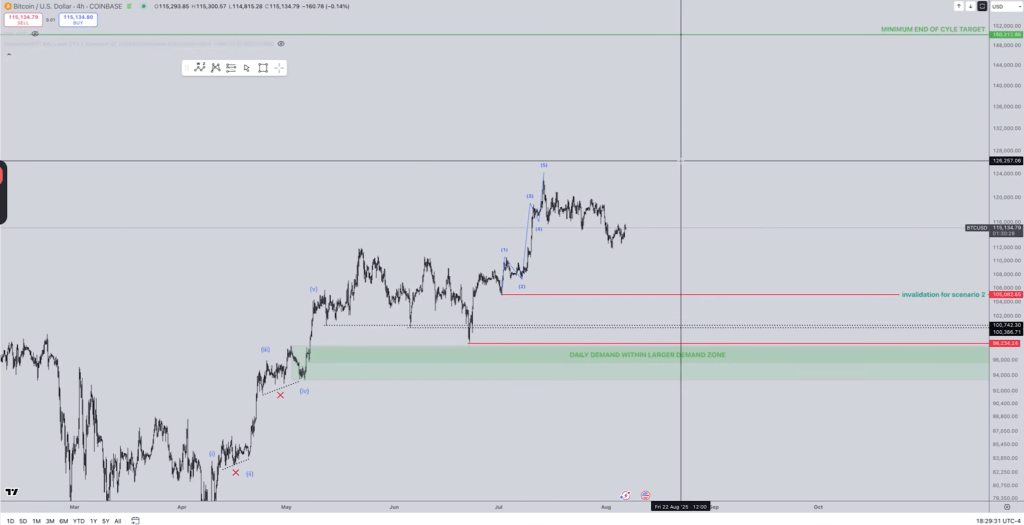

The posts level again to a YouTube video printed two weeks in the past, the place the analyst maps three paths for Bitcoin’s subsequent leg. Two envision an upside reversal in or simply under the present $107,000–$110,000 space, whereas a 3rd permits for a deeper corrective sweep with out violating the secular uptrend.

Related Reading

He is express that pattern invalidation for the cycle sits a lot decrease—he cites the “mid-$70,000s” as the road within the sand, and, in a single passage, locations formal invalidation at $74,000–$75,000—as a result of that’s the place the prior high-time-frame impulse originated and the place the market would, in Elliott-wave phrases, erase the bigger five-wave construction. That framing is why shedding $105,000 would mark a deterioration in momentum somewhat than a terminal break in construction.

Inside his framework, “Scenario 1”—the concept that value remains to be working by means of a compact fourth-wave pause inside an already energetic impulse—has, by his personal admission, grown unlikely. The corrective chop has lasted too lengthy and retraced too deep relative to its second-wave analogue; by classical proportionality, that makes it the flawed diploma for a fourth wave. The technical crimson line for that state of affairs was $110,000; as soon as reclaimed after which overrun to the draw back in the course of the correction, the depend’s symmetry broke down.

“Scenario 2,” his most popular bullish configuration, casts the rally off roughly $105,000 as the primary accomplished five-wave impulse of a brand new advance. In this studying, the market is presently tracing a wave-two pullback with invalidation squarely at $105k.

Related Reading

The implication is arithmetic as a lot as it’s structural: if wave one spanned roughly $20,000 prime to backside, a normal third wave can be bigger, pushing towards not less than the mid-$130,000s earlier than a fourth-wave pause and a terminal fifth carry the transfer into the $150,000-plus area. This is why he characterizes $107,000–110,000 as “one of the best R:R for longs,” the final high-probability staging space for a reversal earlier than invalidation.

“Scenario 3” retains the broader May-to-present correction intact. Here the pop above vary highs was corrective somewhat than impulsive—what technicians name a three-leg rise with overlap—and the market nonetheless owes a deeper sweep into demand.

He differentiates two shapes: a operating flat that defends the June/July lows and finds help in a purple band between ~$103,000 and ~$98,000, and an expanded flat that undercuts these lows and exams the each day demand block that “began at principally 98k,” which value “front-ran… at 98.2k” earlier than bouncing. In each circumstances the higher-time-frame thesis is unchanged, as a result of the structural invalidation stays far under at $74k–$75k.

At press time, BTC traded round $110,019 after hitting an intraday low at $108,666.

Featured picture created with DALL.E, chart from TradingView.com