India’s Income Tax Department has intensified its efforts to curb tax evasion within the cryptocurrency sector, sending greater than 44,000 notices to merchants who didn’t disclose their digital digital asset (VDA) transactions of their earnings tax returns.

Indian Tax Watchdog Ups The Ante

In a latest session of the Rajya Sabha (Upper House of the Parliament), India’s Minister of State for Finance, Pankaj Chaudhary, revealed that the Central Board of Direct Taxes (CBDT) had launched enforcement actions towards non-compliant crypto customers. These embody reassessment notices, surveys, and search-and-seizure operations beneath the Income Tax Act, 1961.

To promote voluntary compliance, the CBDT has initiated focused consciousness efforts by means of its NUDGE marketing campaign (Non-Intrusive Usage of Data to Guide and Enable). Under this program, a complete of 44,057 emails and messages have been issued to people who have been discovered to be investing or buying and selling in crypto belongings however had not reported these transactions of their tax filings.

The Indian authorities launched a tax on digital asset earnings beginning within the 2022-23 monetary 12 months. Since then, taxpayers have reported roughly ₹705 crore ($80.6 million) in crypto-linked earnings for FY 2022-23 and 2023-24 mixed.

However, enforcement actions similar to surveys and raids led to the invention of a further ₹630 crore ($72 million) in undisclosed earnings associated to cryptocurrencies. It’s value noting that accusations of tax evasion have been directed not solely at particular person taxpayers, but additionally at crypto exchanges.

Notably, the CBDT is leveraging information analytics instruments similar to Non-Filer Monitoring System (NFMS), Project Insight, and its inner databases to extend oversight of crypto transactions. The report provides:

These instruments assist cross-reference info offered in tax filings with precise transactions reported by Virtual Asset Service Providers (VASPs) through TDS returns. Discrepancies recognized by means of this method are adopted up with enforcement actions to make sure correct reporting and restoration of tax dues.

Uncertainty Plagues India’s Crypto Ecosystem

While India ranks among the many prime nations globally for crypto adoption, its taxation and regulatory stance have been some extent of competition. The mixture of a 30% tax on crypto income and a 1% TDS on each commerce has discouraged many retail merchants and traders.

As a end result, plenty of crypto exchanges in India have reported dwindling buying and selling volumes, resulting in companies saying layoffs or getting shut. Earlier this 12 months, crypto alternate Bybit introduced it was quickly halting its operations in India because of lack of regulatory readability.

In distinction, neighbouring nation Pakistan has proven a extra receptive strategy towards digital belongings. Earlier this 12 months, the South Asian nation said that it will faucet extra vitality to mine extra BTC.

Similarly, the UAE continues to cement its place as the worldwide hub for crypto companies. In November 2024, the nation eradicated Value Added Tax from all transactions in cryptocurrency exchanges and conversions.

Despite these challenges, there are indicators that India could also be reassessing its strategy. In July 2025, Pradeep Bhandari, spokesperson for the Bharatiya Janata Party (BJP), known as on the federal government to discover making a nationwide Bitcoin reserve, suggesting potential long-term curiosity in integrating crypto into the monetary system.

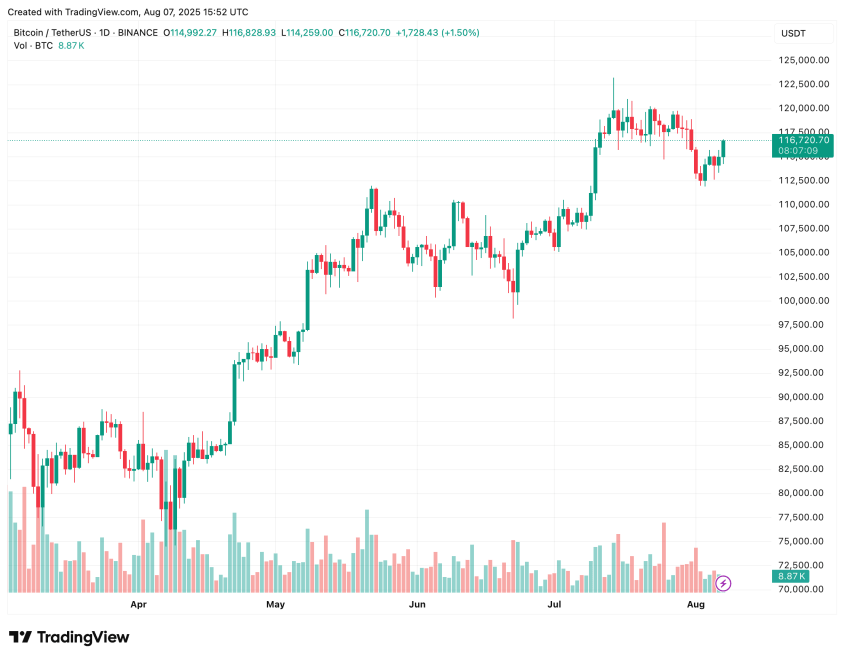

Adding to the momentum, Coinbase, the biggest US-based crypto alternate, is set to re-enter the Indian market later this 12 months, signaling that international companies stay optimistic about India’s long-term crypto potential, even amid short-term uncertainty. At press time, BTC trades at $116,720, up 1.2% previously 24 hours.

Featured picture from Unsplash.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.