Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes has a transparent reply to the market’s favourite bar combat. In an August 21 interview with Ran Neuner, the BitMEX co-founder mentioned each Ethereum and Solana will rally exhausting, however he’s explicitly tilted towards ETH for the rest of the cycle. “Do I consider Solana goes to go up? Absolutely it’s going to go up. Do I consider it’s going to go up greater than ETH? I don’t know. Probably not,” Hayes mentioned. When pressed on portfolio development, he didn’t hedge: “In phrases of a place… you’d be extra obese ETH? Correct. Yes.”

Ethereum Vs. Solana: Who Wins This Cycle?

Neuner framed the context that has flipped the dialog from “Solana-only” to an Ethereum-led commerce, citing a sequence of catalysts—from stablecoins to marquee advocates—that has turned ETH into “the darling asset of Wall Street.” Hayes didn’t contest the premise. Instead, he described the competition between the 2 chains as a “race” more and more outlined by the size of capital now zeroing in on Ethereum: “ETH is a much bigger asset to maneuver, however there’s some huge cash chasing it. So it’s going to be [an] fascinating race.” In different phrases, dimension will not be a bug if flows are thick sufficient; it’s the characteristic that channels the most important bid.

Related Reading

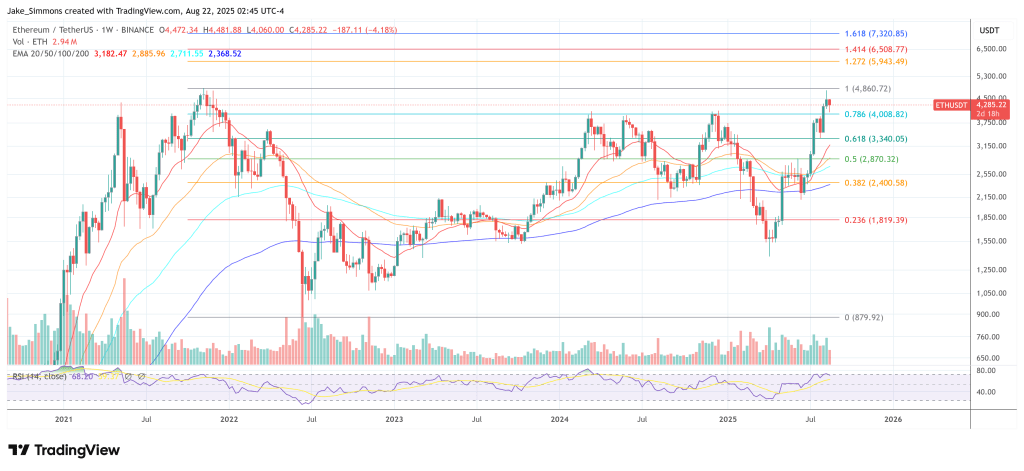

That flows-first view additionally explains why Hayes sees ETH’s upside accelerating as soon as resistance is convincingly cleared. Responding to Neuner’s remark that Bitcoin sits effectively above its prior all-time excessive whereas ETH had been “struggling to interrupt,” Hayes raised his sights past catch-up towards open-ended momentum: “I feel ETH goes to $10,000 [or] 20,000 earlier than the top of the cycle… as soon as it’s damaged by means of, then… it’s a spot of air to the upside.” He added that on shorter time frames, “the chart says it’s going greater now,” noting he had “purchased again a number of the ETH” he beforehand offered.

None of this implies Hayes is bearish on Solana. He disclosed he advises Upexi, a Nasdaq-listed firm with a Solana-focused treasury, and reiterated his expectation that SOL will profit from the identical risk-on currents: “They’re each going to go up. The query is which one goes up extra.” But even with that proximity to the Solana ecosystem, he returned to the relative case: “Do I consider [Solana]’s going to go up greater than ETH?… Probably not.”

Related Reading

Neuner summarized the narrative shift bluntly—ETH “caught this huge Wall Street narrative,” with stablecoins, tokenized property and high-profile champions reminiscent of Joseph Lubin and Tom Lee placing a megaphone behind Ethereum, after a interval when “it’s a SOL cycle” dominated discourse.

Hayes’ reply was to not relitigate the tech stack—Neuner even joked about Solana because the “quick monolithic chain”—however to anchor the ETH-over-SOL name within the mechanics of capital formation and passive demand now assembling round Ethereum’s market construction. In his telling, as institutional autos and public ETH treasury corporations marshal recent inflows, the “greater asset to maneuver” turns into the pure sink for the thickest flows.

Hayes’ comparative view subsequently rests on three on-record pillars. First, positioning: he’s obese ETH versus SOL on a proportion foundation. Second, flows: he expects more cash to chase ETH on this section of the cycle, regardless of (and due to) its bigger base. Third, trajectory: as soon as ETH sustains a breakout, he sees “the sky’s the restrict” dynamics taking up, with a cycle goal of $10,000–$20,000 for ETH. The respect for Solana’s upside stays, however the winner—on Hayes’ numbers and his personal e book—is Ethereum.

At press time, ETH traded at $4,285.

Featured picture created with DALL.E, chart from TradingView.com