Ethereum (ETH) has surged above the $4,000 mark for the primary time since final December, signaling a robust return of bullish momentum. After a number of days of heightened volatility and market uncertainty, consumers have regained management, pushing costs to ranges not seen in months. The breakout displays a mix of enhancing market sentiment, sturdy fundamentals, and rising institutional curiosity within the main sensible contract platform.

Related Reading

On-chain information from CryptoQuant provides additional gasoline to the bullish narrative, displaying that ETH trade reserves proceed to say no steadily. This pattern means that traders — notably massive holders — are shifting their cash off exchanges, lowering obtainable liquidity within the open market. With demand for ETH rising throughout decentralized finance (DeFi), real-world belongings (RWA), and staking actions, the circumstances for a possible provide shock are forming.

Market analysts level to this tightening provide, coupled with constant shopping for stress, as a catalyst for additional positive aspects. If the pattern continues, Ethereum might begin a sustained rally, bringing the subsequent main resistance ranges into focus. For now, merchants are carefully watching whether or not ETH can keep its place above $4,000 and construct a stronger base for a possible run towards its all-time highs.

Ethereum Smart Money Drains Liquidity

According to the newest information from CryptoQuant, solely 18.8 million ETH stays on centralized exchanges — a historic low that underscores the rising shortage of Ethereum within the open market. This isn’t the results of retail merchants making small withdrawals. Instead, it displays a deliberate transfer by institutional gamers and “sensible cash” to build up and safe massive quantities of ETH off exchanges.

This accelerated outflow is creating a transparent provide squeeze. With fewer cash obtainable for spot buying and selling, upward value stress is more likely to construct, particularly if demand continues its present trajectory. The tempo of accumulation means that these massive holders are positioning for a long-term play, lowering market liquidity and setting the stage for vital value volatility to the upside.

Adding to the bullish outlook, public corporations are starting to undertake Ethereum as a part of their treasury methods. Sharplink Gaming, for instance, has not too long ago bought substantial quantities of ETH, becoming a member of a rising checklist of corporations diversifying into digital belongings. Meanwhile, growing authorized readability within the United States is opening the door for broader adoption, decreasing boundaries for each institutional and company participation within the Ethereum ecosystem.

Related Reading

These converging elements — institutional accumulation, diminished trade reserves, and regulatory inexperienced lights — are forming a market atmosphere not like something seen earlier than in Ethereum’s historical past. If the pattern persists, analysts count on the approaching months to ship unprecedented value motion, fueled by an ideal storm of tightening provide and rising demand. In such circumstances, Ethereum couldn’t solely maintain its place above $4,000 but additionally make a decisive push towards new all-time highs.

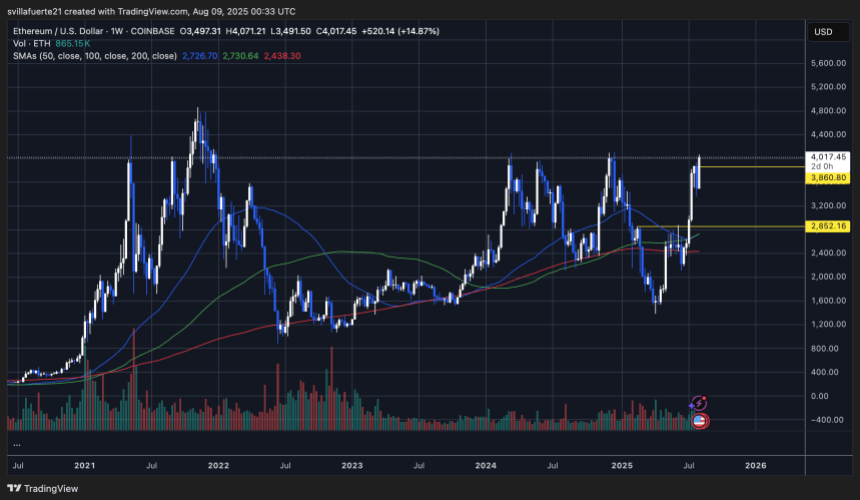

ETH Breaks $4,000, Tests Key Weekly Resistance

Ethereum’s weekly chart exhibits a decisive breakout above the $3,860 resistance degree, pushing the worth to $4,017 — its highest degree since December 2024. This surge marks a 14.87% weekly acquire, highlighting robust bullish momentum following weeks of accumulation and restoration from the $2,852 assist zone.

The present value motion is supported by the 50, 100, and 200-week SMAs trending under the market, with the 50-week SMA at $2,726 reinforcing the energy of the long-term uptrend. Volume has additionally spiked considerably, indicating that the breakout is pushed by actual shopping for curiosity relatively than speculative noise.

Featured picture from Dall-E, chart from TradingView