On-chain knowledge reveals capital inflows into Bitcoin and Solana have slowed over the previous week, whereas Ethereum’s progress has been resilient.

Realized Cap Shows Divergence Between Ethereum & Bitcoin

In a brand new submit on X, on-chain analytics agency Glassnode has mentioned about how the Realized Cap has modified for a number of the belongings within the cryptocurrency sector. The “Realized Cap” refers to a capitalization mannequin that calculates a given coin’s complete worth by assuming the ‘true’ worth of every token in circulation is the spot value at which it was final concerned in a transaction.

In quick, what this indicator represents is the entire quantity of capital that the buyers of the cryptocurrency as a complete have saved into it. Changes in its worth, subsequently, correspond to the influx or outflow of capital.

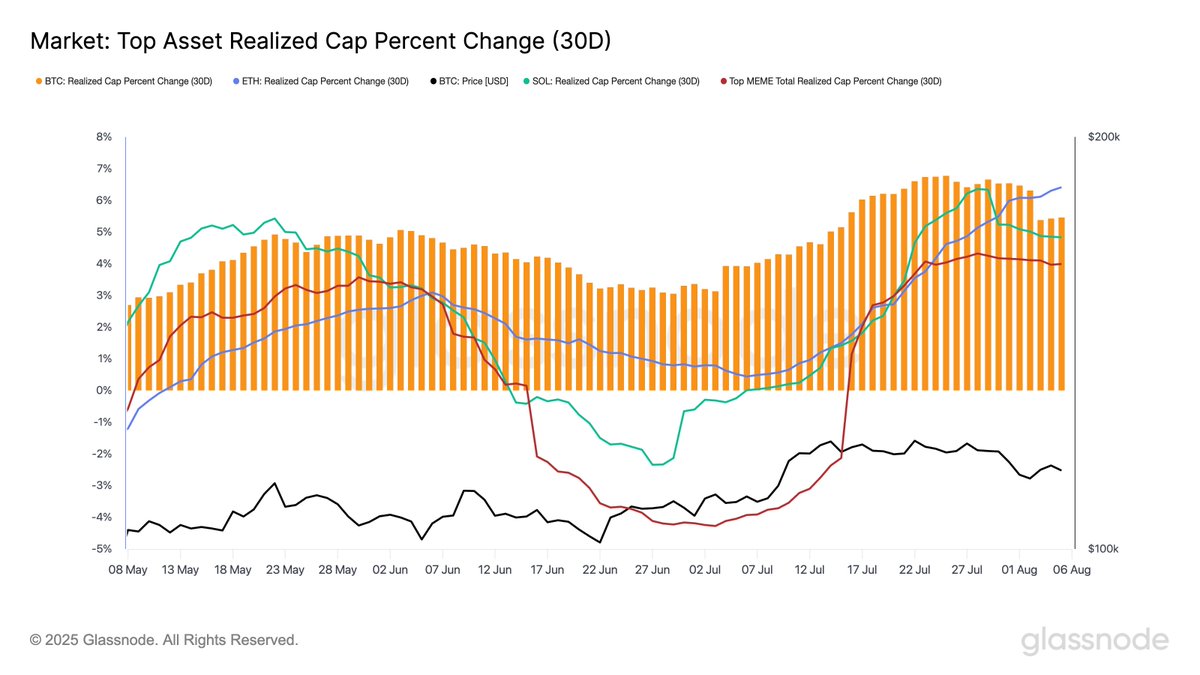

Below is the chart shared by Glassnode that exhibits the 30-day proportion change within the Realized Cap for just a few totally different digital belongings.

Looks just like the trajectory of the metric hasn't been uniform throughout the sector in latest days | Source: Glassnode on X

From the graph, it’s seen that the month-to-month change within the Realized Cap is presently optimistic for all 4 of Bitcoin, Ethereum, Solana, and the highest memecoins. This means that capital has flowed into the market during the last 30 days.

Though, whereas that is true, BTC and SOL have been displaying a shift within the quick time period. One week in the past, the Realized Cap change for them stood at 6.66% and 6.34%, respectively. But at present, the metric’s worth has come down to five.46% and 4.84%. Still notably optimistic, after all, however does mirror a slowdown in demand.

Interestingly, whereas these two tokens have witnessed this pattern, ETH has continued its Realized Cap progress with the share change leaping from 5.32% to six.41%. This could also be a sign that capital is rotating from different belongings into the token quantity two by market cap.

The prime meme-based tokens have seen a flat pattern within the indicator in the course of the previous week, which, in keeping with the analytics agency, is one other signal of “cooling danger urge for food.”

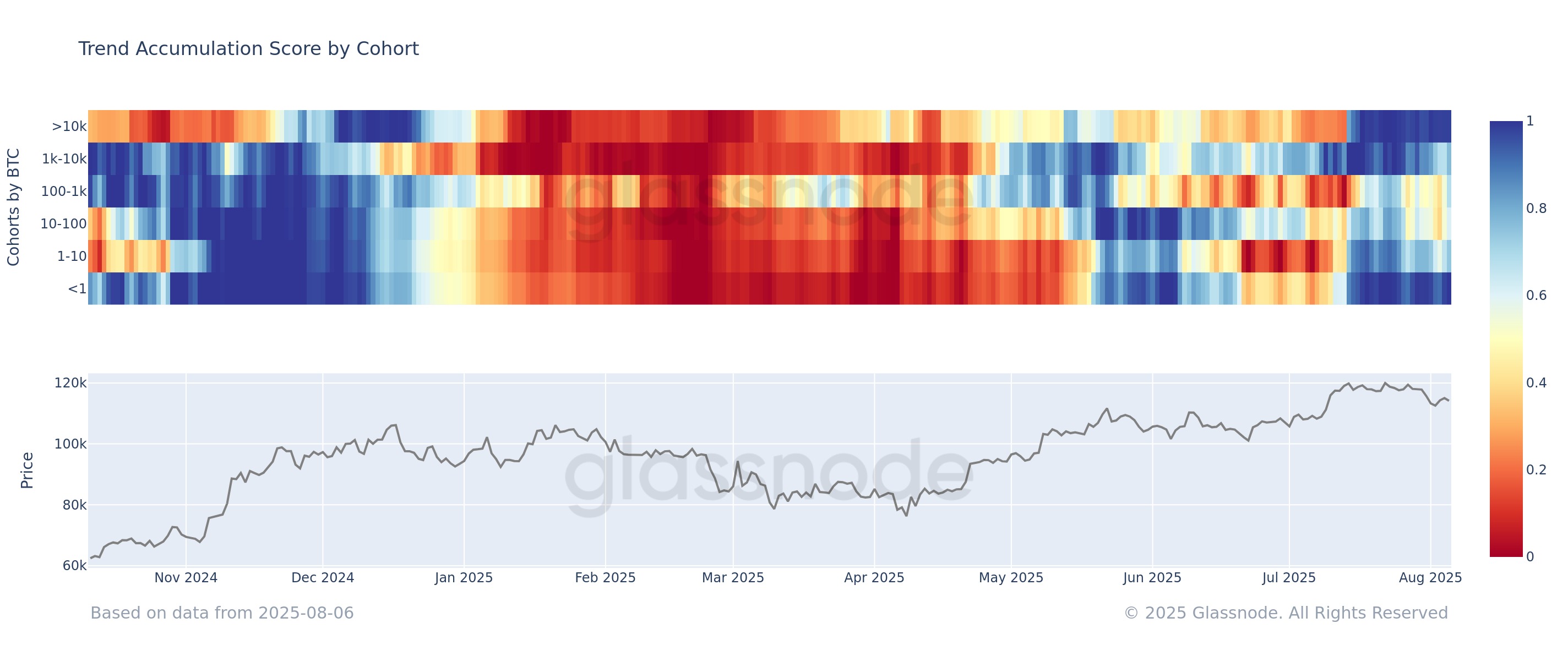

In another information, each the most important and smallest of buyers on the Bitcoin community have been accumulating on the identical time just lately, as Glassnode has identified in one other X submit.

The pattern within the BTC Accumulation Trend Score for the totally different cohorts | Source: Glassnode on X

In the chart, the information of the “Accumulation Trend Score” is proven, which tells us about whether or not Bitcoin buyers are accumulating or distributing. A price near 1 implies dominant shopping for, whereas a price close to 0 suggests promoting strain.

As is obvious from the graph, the metric’s worth has been fairly near 1 for each under 1 BTC and above 10,000 BTC buyers. “This suggests preliminary dip-buying in the course of the latest correction,” notes the analytics agency. That mentioned, Glassnode additionally cautions that the sign is lagging, with investor conduct smoothed over a 15-day window.

BTC Price

At the time of writing, Bitcoin is floating round $115,100, down over 2% within the final seven days.

The value of the coin appears to have been up and down over the previous few days | Source: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.