Strategy Inc. has purchased extra Bitcoin whereas markets wobble, including one other small slice to its huge crypto treasury.

According to the corporate, it bought 430 BTC for about $51.4 million, at a mean value close to $119,666 per coin. The transfer retains Strategy in its acquainted function as one of many largest company holders of Bitcoin.

Purchase Details And Holdings

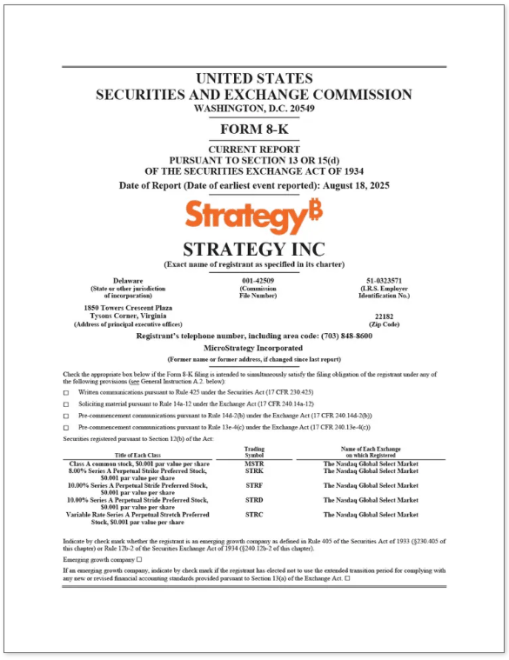

Based on the agency’s disclosure and SEC filings, the firm now holds 629,376 BTC, which represents virtually 3% of the full Bitcoin provide.

Strategy has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 $BTC acquired for ~$46.15 billion at ~$73,320 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/FLRjCKDMQO

— Michael Saylor (@saylor) August 18, 2025

Reports place the combination price of that stash at about $46.15 billion. The newest 430 BTC got here after the corporate raised cash by promoting inventory; proceeds from STRK, STRF, and STRD share gross sales — roughly $19.3 million, $19 million, and $12.1 million respectively — had been used to fund the acquisition.

Michael Saylor additionally hinted at new shopping for in a Sunday submit on X, captioned “Insufficient Orange.”

The contemporary buy is the third consecutive weekly purchase. That sample exhibits the corporate is sticking to a gentle accumulation behavior. But within the scale of its holdings, 430 BTC is tiny — a routine top-up relatively than a big strategic shift.

Insufficient Orange pic.twitter.com/QcRT0RTzEg

— Michael Saylor (@saylor) August 17, 2025

New Equity Guidance And Funding Rules

Reports have disclosed an replace to the corporate’s Equity at-the-Market steerage tied to mNAV ranges. The agency will actively concern MSTR shares when the market NAV a number of (mNAV) is above 4.0x.

When mNAV sits between 2.5x and 4.0x, it’ll concern shares to purchase extra BTC. If mNAV falls beneath 2.5x, the corporate says it’ll prioritize paying curiosity on debt and funding most popular fairness dividends.

BTCUSD buying and selling at $115,943 on the 24-hour chart: TradingView

There can also be a observe that the corporate could think about using credit score to repurchase MSTR shares when mNAV is beneath 1.0x.

That steerage issues as a result of issuing shares impacts fairness holders. Reports current this as a instrument the corporate intends to make use of relying on market circumstances.

Market Moves And Stock Reaction

Bitcoin pulled again within the final week and the corporate’s inventory fell alongside it. Bitcoin is down virtually 5% prior to now seven days and slid beneath the psychological $115,000 mark at one level.

MSTR inventory dropped greater than 8% during the last 5 days, slipping from a previous shut of $365 to roughly $357 in current buying and selling.

Featured picture from Meta, chart from TradingView

Editorial Process for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.