Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

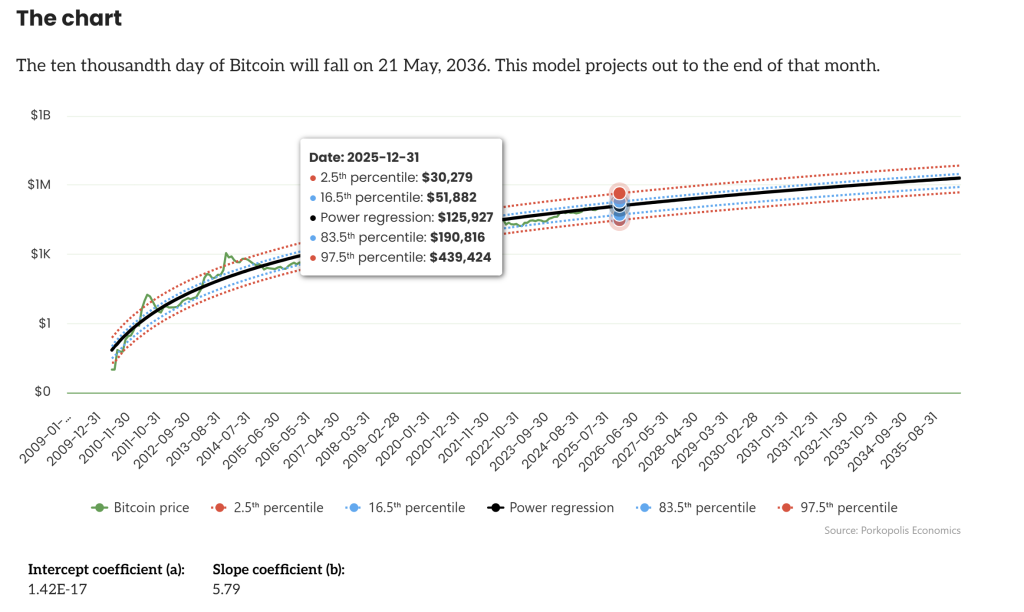

Matthew Mežinskis, the analyst behind Porkopolis Economics and co-host of the “crypto_voices” podcast, instructed Marty Bent on TFTC that Bitcoin’s late-cycle upside stays bigger than most fashions indicate, arguing that worth motion continues to trace a long-standing “energy development” that has ruled each prior increase. Anchoring his view in percentile “bands” round that development, he contends the market can nonetheless ship a two-to-three-times transfer into year-end, putting a $250,000 to $375,000 vary in play.

Bitcoin 4-Year Cycle Still In Play?

Mežinskis frames the thesis in stark, testable phrases. “Bitcoin has historically in the course of the booms very simply gotten above the Eightieth percentile every time,” he mentioned, noting that the strongest phases in earlier cycles climbed “very simply” above the Ninetieth as nicely. He defines the Eightieth percentile as roughly 1.3× the development and the Ninetieth as 2×. On his mannequin, the end-2025 development worth sits close to $125,000, which fixes the Eightieth-percentile validation line at about $170,000 and the Ninetieth at $250,000. “If we don’t get above 170k by 12 months finish or into like the primary couple months of subsequent 12 months then I might…rethink the thought of the four-year cycles,” he mentioned, earlier than stressing that “it hasn’t been invalidated but.”

Related Reading

The centerpiece of his outlook is an easy rule-of-thumb extrapolation from these bands. “The Ninetieth is 2x…so 2x is $250k,” he defined. He then extends the historic envelope to the mid-90s percentiles to measurement a extra aggressive—however nonetheless precedent-based—goal. “In 2021…it was a 96th percentile…the two.8x—spherical it right here—3x,” he mentioned. “Totally base case, completely doable…can be 2 to 3x the development…$250k to $375k Bitcoin.” Even as he embraces that vary, he tempered expectations for a blow-off past it. “I might be very shocked if Bitcoin went above $350 or $375k by the tip of the 12 months, however I feel it’s doable.”

His framework is intentionally non-technical within the chartist sense. “We’re simply wanting on the energy development and the place the worth sometimes is over or beneath development each 4 years,” he mentioned. The mannequin—represented by a “black line” he’s tracked since 2016—has, in his telling, proved extra sturdy than the once-fashionable stock-to-flow method: “It’s like the very best development line in all of finance…definitely higher than the outdated stock-to-flow ratio.”

The percentile overlays are frequency-based markers: the Ninetieth denotes a stage above which solely 10 % of observations sit, the 99th above just one %. Historically, he noticed, probably the most explosive cycles—2013 and 2017—briefly reached the 99th percentile, roughly 4.6× development, a zone 2021 by no means touched. That “softer high” dynamic is constant, he argues, with maturation: “As Bitcoin will get extra adopted, these peaks do come down.”

Pushing past the bottom case, Mežinskis addressed the outlier narratives circulating on social media. He acknowledged listening to projections within the “$444,000 in November” neighborhood and mapped them to his high-percentile bands: “400,000 is the 97th…[between] the 97th and 98th percentile, it’s fairly uncommon.” Those ranges, at about 3½× development, are—by definition—ranges the market spends little or no time above.

Related Reading

None of this, he emphasised, is a timer. The framework “doesn’t let you know the time…we’re simply assuming the four-year cycle.” If the cycle extends or compresses, the mannequin gained’t predict that path; it solely sketches the altitude the market has traditionally achieved as soon as a increase is underway. “If the market will get heated…if grandma’s getting excited this Thanksgiving…and giving her grandchildren cash to purchase Bitcoin, then maybe it might occur once more,” he quipped, earlier than reiterating: “Absolutely doable that we’ve got decrease highs and even doable that we get out of the four-year cycle, however I’m nonetheless not seeing it based mostly on the worth motion.”

Mežinskis additionally flagged the hazards that usually observe euphoria, warning that narrative shifts at elevated plateaus can coincide with leverage-driven fragility. Should Bitcoin treasury firms lever short-dated convertible debt to chase larger costs, a downturn might expose maturity and liquidity mismatches.

“You might see completely a cascading [of] liquidations of those Bitcoin treasury firms,” he mentioned, including that reflexive waves can “go as excessive because the White House” when it comes to coverage consideration if the cycle crescendos at scale. He was cautious to not current that as a base case—“I’m not saying that it’s going to”—a lot as a reminder that what climbs on leverage can unwind via the identical channel.

The check he units for the market over the subsequent few months is crisp. A transfer above the Eightieth-percentile line—about $170,000 given his end-2025 development—would hold the four-year template intact; a run into the Ninetieth-percentile band would align with prior booms and mechanically prints a ~$250,000 spot worth; an tour towards the mid-90s percentiles would lengthen the tape to roughly $375,000, a stage he calls the “max” he would anticipate this cycle—even when, as historical past exhibits, temporary overshoots can’t be dominated out. For now, the construction that’s guided Bitcoin since 2016 “hasn’t been invalidated but,” and till it’s, Mežinskis’ message is unambiguously bullish: the bands are there, the tape has visited them earlier than, and the higher ones nonetheless sit far above spot.

At press time, BTC traded at $110,397.

Featured picture created with DALL.E, chart from TradingView.com