Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

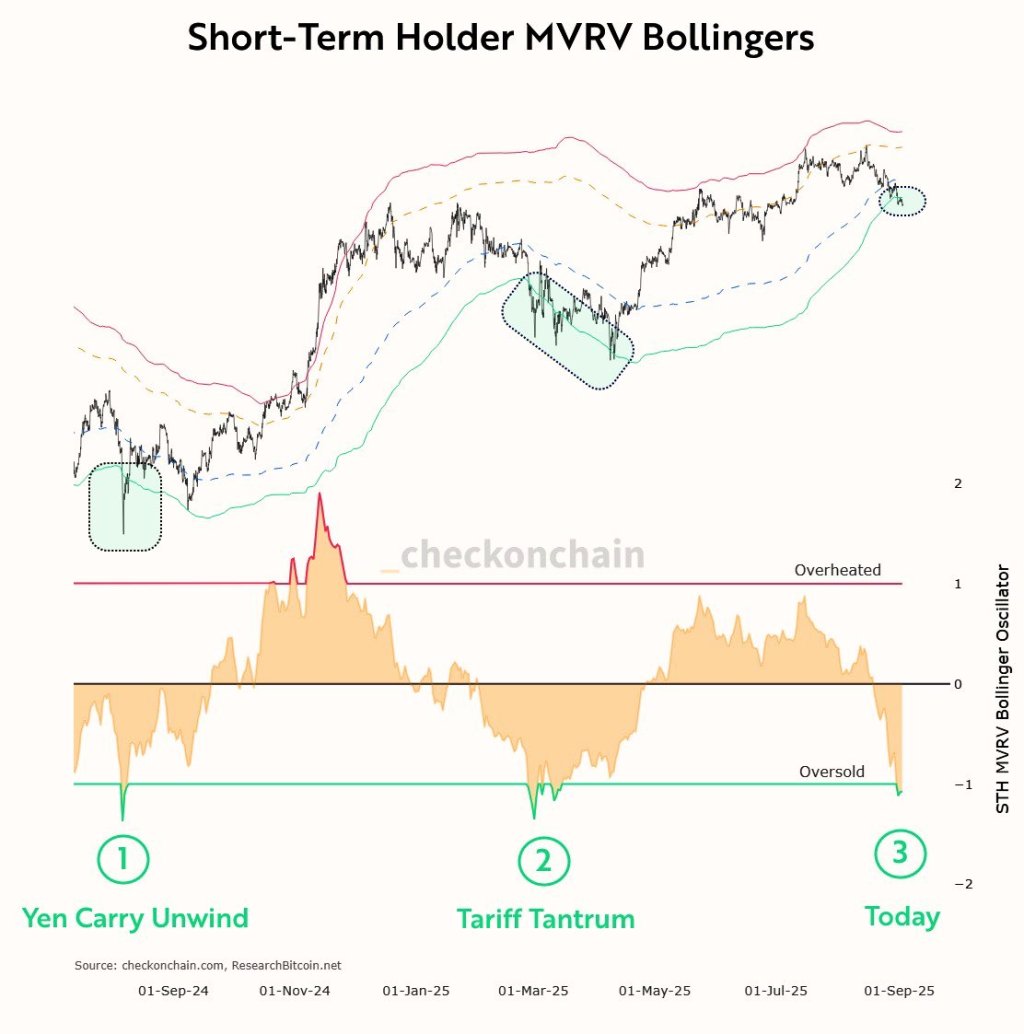

Bitcoin flashed a short-term “purchase” sign that beforehand marked the $49,000 and $74,000 swing lows, in keeping with on-chain analyst Frank (@FrankAFetter), a quant at Vibe Capital Management. “Officially received the Oversold print on the short-term holder MVRV bollinger bands,” he wrote on X, pointing to prior occurrences throughout the “Yen Carry Unwind” round $49,000 and the “Tariff Tantrum” close to $74,000, including a 3rd occasion “Today – $108k.

The metric in focus blends the short-term holder market-value-to-realized-value (STH-MVRV) ratio with Bollinger Bands to seize when newer cash commerce at statistically depressed valuations versus their price foundation. In the chart Frank shared, the STH-MVRV Bollinger oscillator probed the oversold threshold that beforehand aligned with native exhaustion of promoting.

Related Reading

More Reasons To Be Bullish For Bitcoin

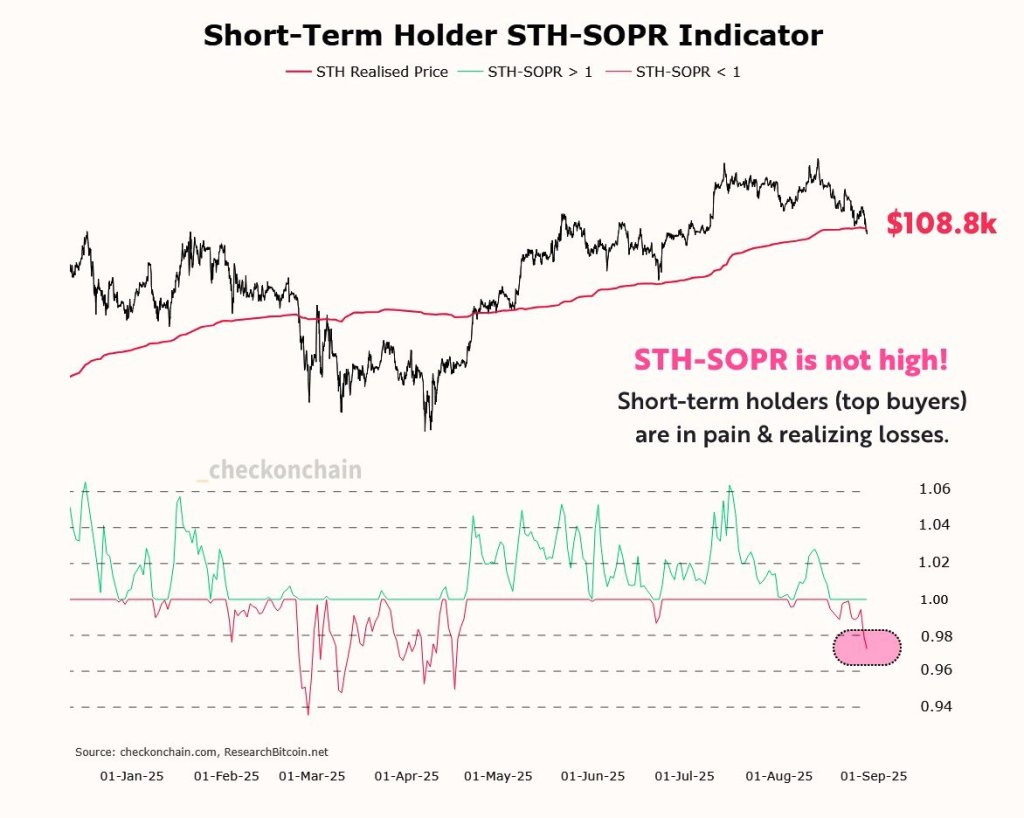

On a companion panel, the STH-SOPR gauge—spent-output revenue ratio for cash youthful than roughly 155 days—stays beneath 1.0, signaling that latest patrons are realizing losses into the tape slightly than earnings. “Short-term holders (high patrons) are in ache & realizing losses,” Frank famous, emphasizing that “STH-SOPR will not be excessive!”

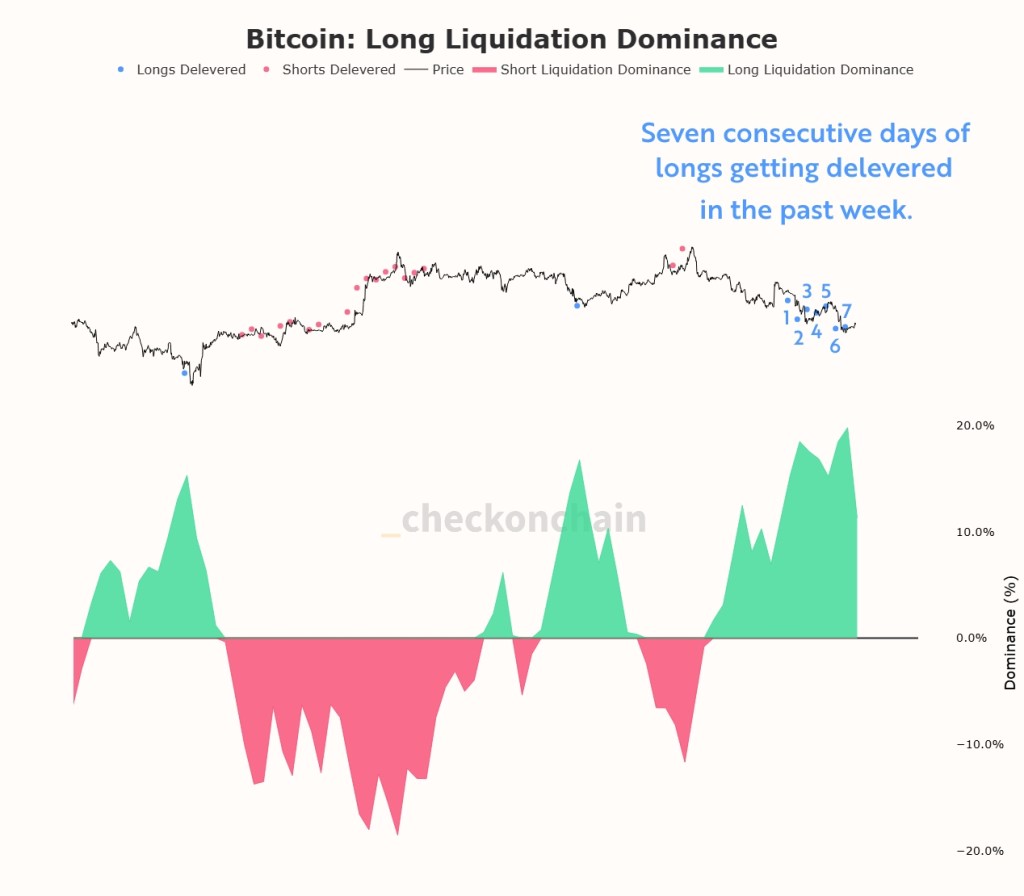

Positioning has additionally turned cleaner in derivatives. “Longs received ‘delevered’ day by day final week—that’s seven straight days of magic blue dots,” he mentioned, describing persistent lengthy liquidations and balance-sheet shrinkage amongst leveraged bulls. He is now “waiting for the flip: after they surrender and begin shorting with leverage (precisely on the improper time), offering gas for a possible reduction squeeze.”

Macro context could also be additive, in his view. “Gold hit new highs final week. ‘Gold leads, bitcoin follows.’ The yellow metallic typically seems to be round corners, and it is perhaps sniffing out the debasement commerce headed into 2026 because the administration stokes the financial system for mid-terms,” he wrote, suggesting a possible catch-up dynamic if Bitcoin lags the transfer in bullion.

Related Reading

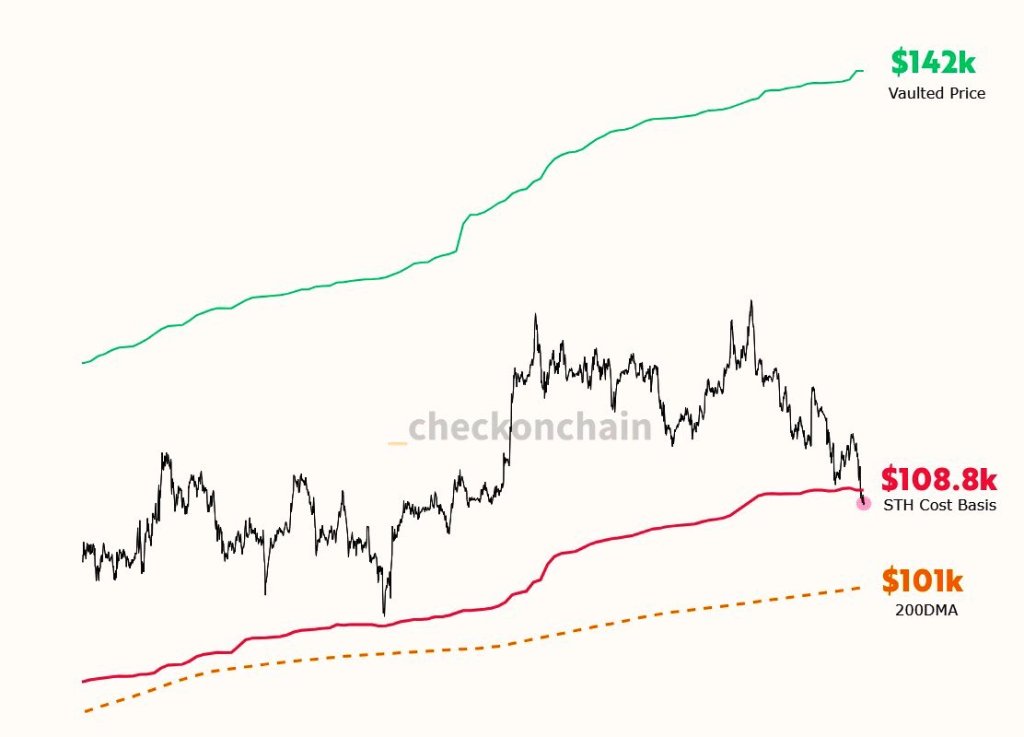

Risk markers stay clearly outlined. Frank pegs the short-term holder realized worth—an mixture price foundation for latest cash—at $108,800. “If BTC breaks down beneath the short-term holder price foundation of $108.8k, it might wish to examine demand on the 200-day transferring common, which sits at $101k.”

That layered help map frames the oversold print as a tactical sign inside a still-intact longer-term uptrend, but it surely additionally acknowledges that violations of STH price foundation can prolong exams towards the cycle’s main development gauge.

Taken collectively, the confluence of those indicators presents a powerful confluence, in keeping with Frank. Whether historical past rhymes once more will hinge on spot demand rising above short-term price foundation and on whether or not any shift towards aggressive shorting gives the gas for a squeeze. As Frank summarized, “If we’re in a bull market—and I imagine we’re—that is the sort of habits that usually units the stage for the subsequent leg increased.”

At press time, BTC traded at $111,382.

Featured picture created with DALL.E, chart from TradingView.com