Bitcoin’s worth motion this month has left merchants watching intently as huge gamers double down on bullish calls. According to VanEck’s analysis, the funding agency has reaffirmed a $180,000 year-end goal even after Bitcoin slid from a latest excessive, an indication that some institutional patrons aren’t backing away regardless of a pullback.

Related Reading

Institutional Buying Remains Heavy

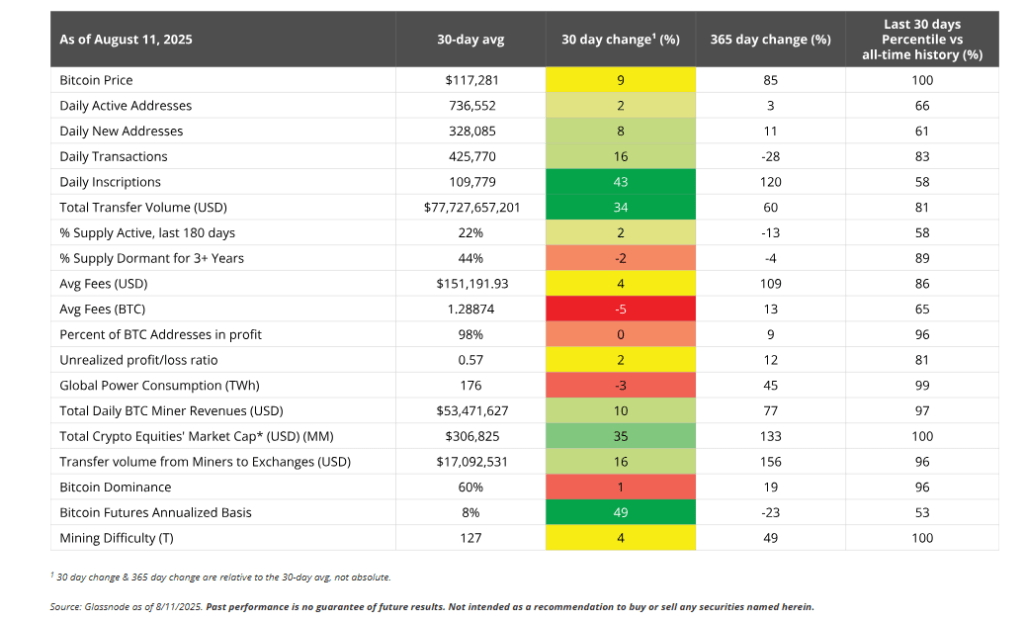

Reports have disclosed heavy accumulation in July. Exchange-traded merchandise purchased 54,000 BTC whereas Digital Asset Treasuries added 72,000 BTC, giving clear proof that giant holders proceed to pile in.

VanEck first laid out its bullish view in November 2024 when Bitcoin traded round $88,000. At the identical time, US-listed miners now account for 31% of worldwide Bitcoin hashrate, up from roughly 30% earlier this 12 months, at the same time as fairness index fell 4% when excluding Applied Digital’s 50% leap.

Price Moves Show Volatility And Quick Recovery

Bitcoin slid to $112,000 in early August earlier than leaping again to $124,000 on August 13. That transfer set a brand new all-time excessive above July’s $123,838.

At the time of writing, Bitcoin trades near $115K, roughly 8% under that latest peak. Traders describe the pullback as a repositioning after a run-up, not an apparent breakdown.

Source: VanEck

Derivatives metrics again the image of rising speculative curiosity. CME foundation funding charges have surged to 10%, the very best stage since February 2025.

Options markets present name/put ratios hitting 3.21x, the strongest since June 2024, with buyers spending $792 million on name premiums.

Yet implied volatility has compressed to 32%, properly beneath the one-year common of fifty%, which makes choices cheaper for patrons.

On the opposite hand, futures open curiosity sits over $6 billion, although a $2.3 billion unwind in open curiosity throughout latest corrections ranks among the many bigger single-session strikes.

Source: VanEck

Voices Split On How High Bitcoin Could Go

Executives and analysts disagree on the tempo and peak of the rally. Coinbase CEO Brian Armstrong joined figures equivalent to Jack Dorsey and Cathie Wood in suggesting Bitcoin might attain $1 million by 2030, citing clearer guidelines and wider institutional adoption.

Galaxy Digital’s Mike Novogratz warned {that a} million-dollar stage would extra seemingly replicate extreme US financial stress than regular market energy.

Preston Pysh flagged issues about how Wall Street’s rising position may change Bitcoin’s use and tradition.

Related Reading

Support Levels And Technical

Technically, many market watchers view the $100,000-$110,000 vary as key assist. A decisive break under $112,000 might push costs towards $110,000 and, in a deeper transfer, $105,000.

For now, the story is blended. Institutional demand and speculative derivatives flows are pushing worth stress increased, whereas low-cost choices and compressed volatility make bullish bets more cost effective.

Whether that mixture lifts Bitcoin to VanEck’s $180,000 goal will rely on continued inflows and whether or not key assist holds.

Featured picture from Meta, chart from Buying and sellingView