Bitcoin (BTC) fell to $114,386 earlier at the moment, triggering almost $300 million in liquidations over the previous 24 hours as investor confidence within the asset stays shaky. Still, rising spot buying and selling volumes provide a glimmer of hope that BTC might now be coming into an accumulation section.

Is Bitcoin In The Accumulation Phase?

According to a CryptoQuant Quicktake publish by contributor Amr Taha, Binance’s BTC spot buying and selling quantity surpassed $6 billion on August 18 – one of the important spikes this month.

Taha famous that such sudden spikes usually sign elevated participation from institutional buyers and huge merchants, together with some retail exercise trying to capitalize on heightened volatility.

It’s price noting that the surge in Binance spot quantity coincided with BTC’s drop under $115,000 – a motion that may function a number one indicator of a possible reversal in worth momentum.

Historical knowledge means that robust spot shopping for throughout worth dips typically displays merchants stepping in to build up BTC at discounted costs. This dynamic can ease promoting strain and lay the inspiration for a rebound if demand persists.

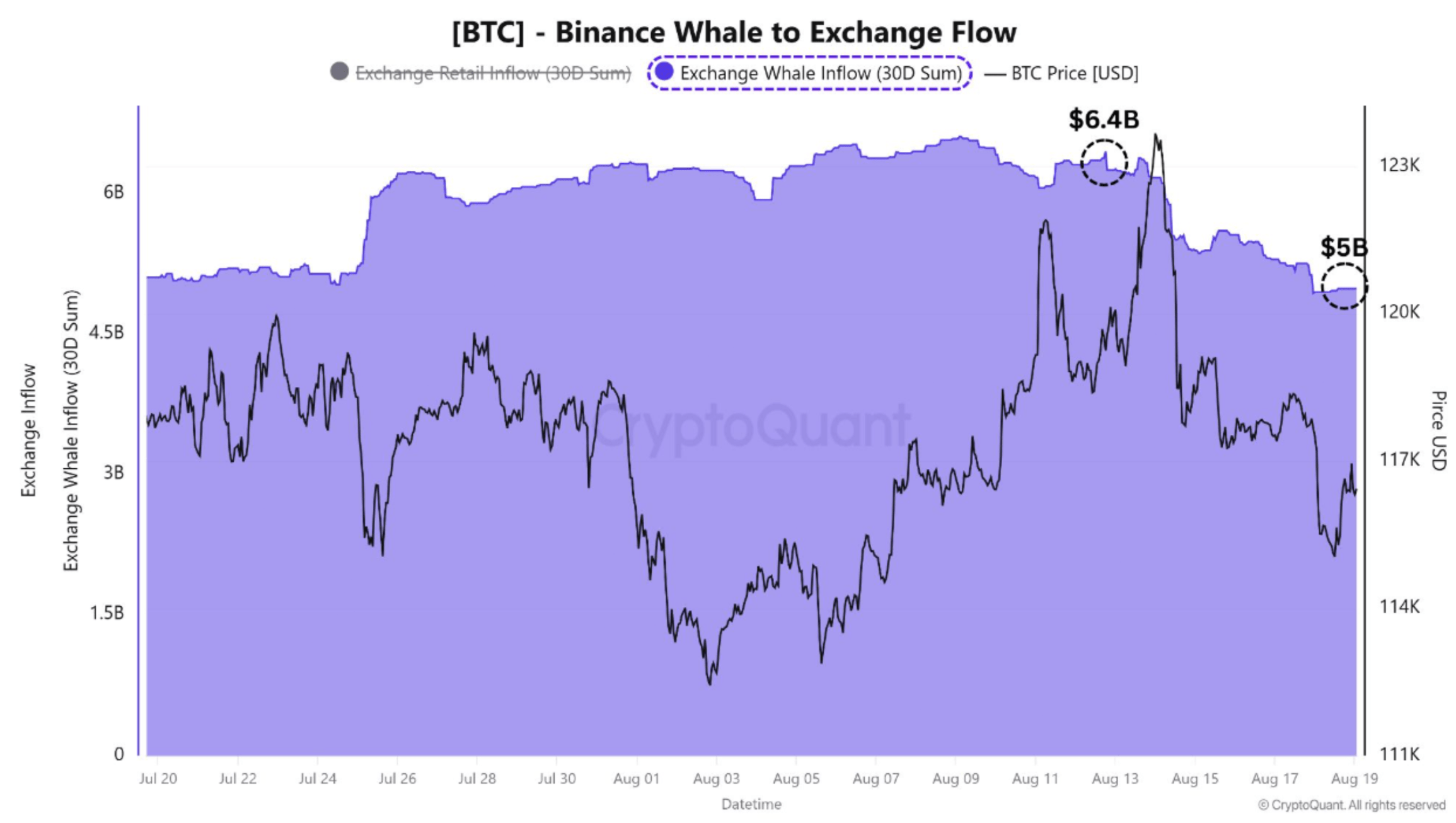

Taha additionally highlighted that the rise in Binance spot quantity occurred alongside a decline within the Binance Whale-to-Exchange Flow, which fell from $6.4 billion to $5 billion – a $1.4 billion drop in whale transfers to Binance over the previous week.

This discount in whale deposits suggests fewer massive holders are sending BTC to exchanges for potential promoting, a development usually thought of bullish. Taha concluded:

Bringing these components collectively – a surge in Binance spot quantity, rising demand throughout a worth dip, and a decline in whale deposits – the market is displaying early indicators of stabilization. If accumulation continues at present ranges, Bitcoin has a strong probability to get well and retest increased resistance ranges within the close to time period.

From a technical perspective, crypto analyst Titan of Crypto famous that BTC remains to be following its weekly trendline. If the development holds, BTC might goal $130,000 within the coming weeks.

Warning Signs For September

While Taha suggests BTC might at present be in an accumulation section with the potential for a development reversal within the coming months, different analysts stay cautious. Crypto analyst Josh Olszewics warned that BTC should survive a “brutal September” earlier than any significant rebound can happen in This autumn 2025.

Similarly, CryptoQuant contributor BorisVest cautioned that the subsequent 1–2 weeks might convey heightened promoting strain for the highest cryptocurrency by market capitalization. At press time, BTC trades at $115,489, down 0.1% over the previous 24 hours.