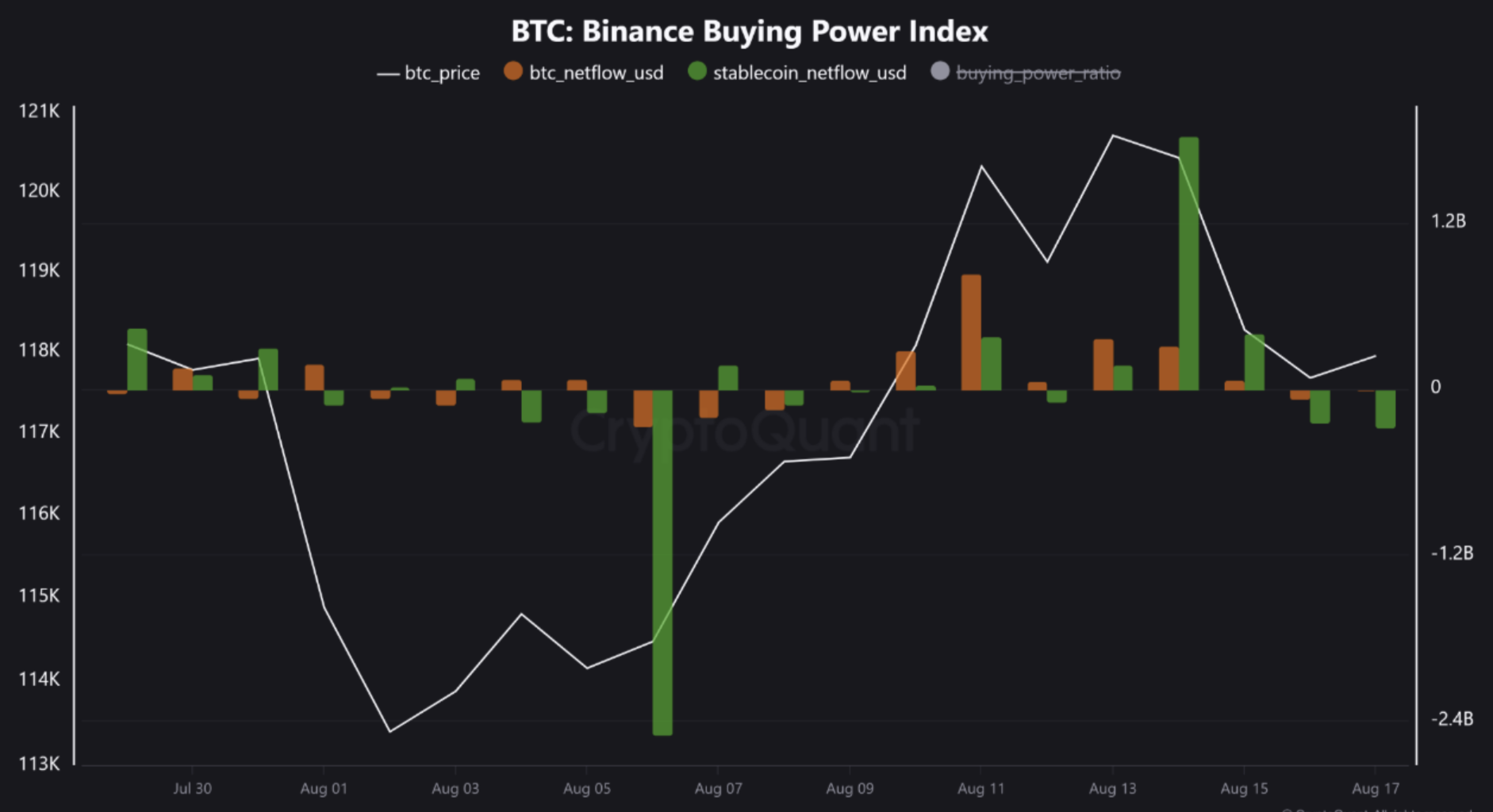

Earlier at this time, Bitcoin (BTC) slipped under $115,000 for the primary time since August 6, elevating issues that the cryptocurrency’s bullish momentum could also be fading. Against this backdrop, the Binance Buying Power Ratio means that demand for BTC may very well be weakening, probably setting the stage for a deeper value correction.

Binance Buying Power Ratio Raises Alarms

According to a CryptoQuant Quicktake submit by contributor Crazzyblockk, the Binance Buying Power Ratio serves as a dependable indicator of general market well being. The analyst defined that the present studying factors to a potential downturn for Bitcoin.

Related Reading

To clarify, the ratio measures stablecoin inflows in opposition to Bitcoin outflows on Binance, primarily displaying how a lot new capital is available for purchase BTC in comparison with how a lot is leaving the change. A rising ratio displays robust shopping for energy and liquidity, whereas a pointy drop alerts weaker demand and a better danger of correction.

Recently, the ratio suffered a steep decline, issuing what the analyst known as a “textbook warning” simply earlier than BTC’s newest value drop. The correction noticed Bitcoin fall from as excessive as $124,474 on August 13 to a low of $114,786 earlier at this time.

The analyst famous that the ratio peaked at 2.01 on August 14, displaying peak shopping for strain the place for each $1 of BTC shifting to chilly storage, greater than $2 in stablecoins entered the market.

In the next days – from August 16 to 17 – the ratio witnessed a pointy reversal, crashing to -0.81 inside 48 hours. As a outcome, extra shopping for energy left Binance than entered it, confirming that the BTC market’s main gasoline supply was exhausted.

Subsequently, BTC underwent a sustained value correction, falling 4.7% over the previous seven days. Currently, the cryptocurrency is hovering barely under $115,000, whereas its subsequent main assist lies across the $110,000 stage. Crazzyblockk concluded:

This evaluation proves that Binance is the market’s heart of gravity. Its capital flows are an early warning system. A falling Buying Power Ratio alerts exhausted liquidity and excessive correction danger. For any severe analyst, monitoring Binance isn’t optionally available – it’s important.

How Will Bitcoin Perform In September?

If Bitcoin avoids slipping under $110,000, the short-term holder price foundation mannequin suggests its subsequent main resistance lies round $127,000. A robust breakout above this stage may ship BTC climbing towards $140,000.

Related Reading

In a separate X submit, crypto analyst KillaXBT stated BTC should maintain above $115,787 to focus on the $125,000 – $127,000 vary in September. However, the analyst warned that even when Bitcoin opens the month with a recent all-time excessive, it might not assure sustained bullish momentum. At press time, BTC trades at $114,988, down 2.4% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com