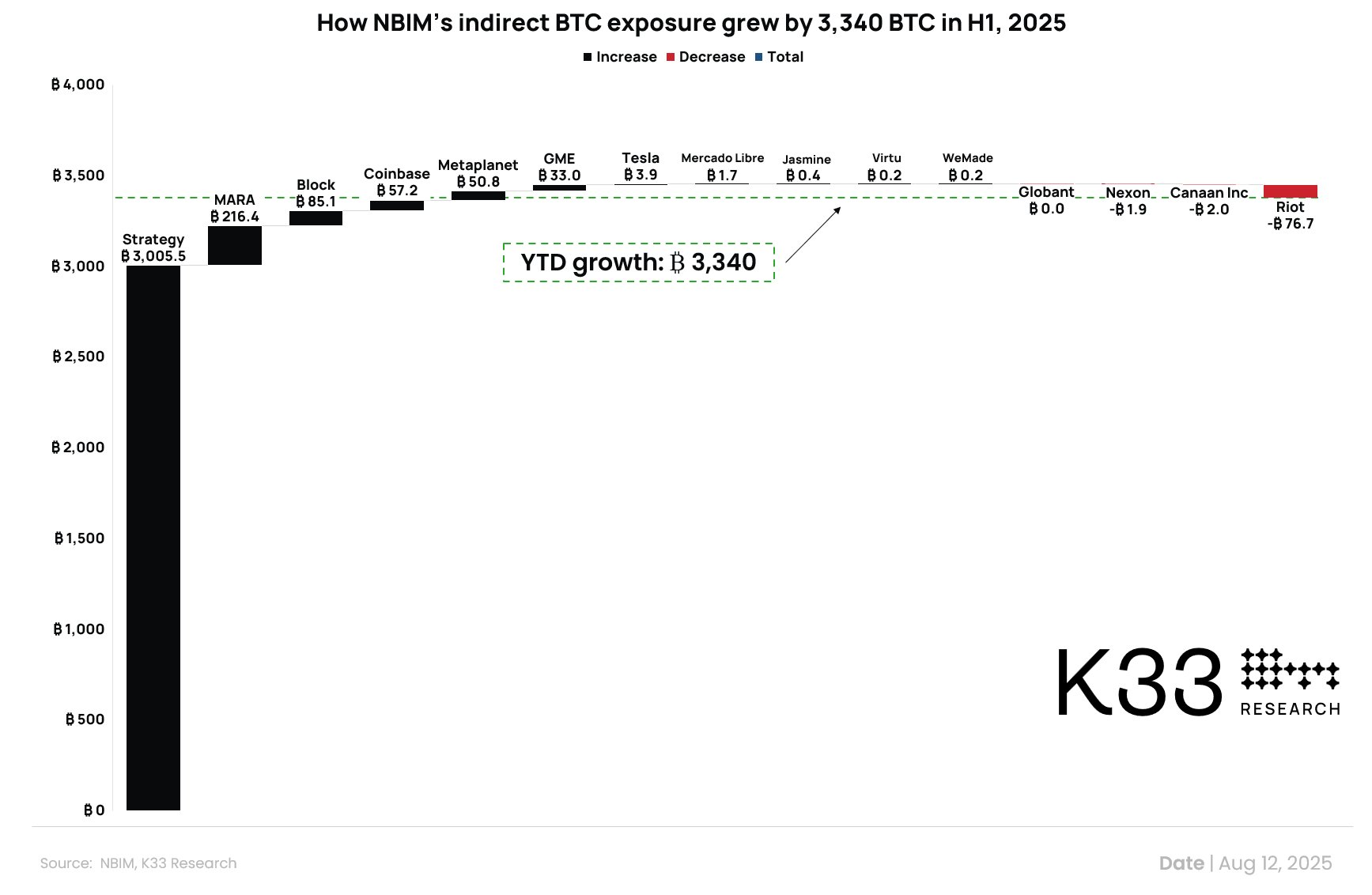

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), has elevated its oblique holdings of Bitcoin to 7,161 BTC, valued at roughly $862.8 million as of June 30, in response to new evaluation from K33.

This represents an 87.7% rise within the final six months and a 192.7% improve over the previous 12 months. The beneficial properties stem largely from the fund’s positions in firms with important Bitcoin treasuries, together with Strategy, Block, Coinbase, Marathon Digital Holdings (MARA), and Metaplanet.

K33 Head of Research Vetle Lunde defined that the calculation relies on NBIM’s shareholdings in these companies, multiplied by the quantity of Bitcoin they maintain.

While Lunde famous the publicity is probably going an final result of NBIM’s broad, diversified funding technique relatively than a focused wager on Bitcoin, he highlighted it as a transparent instance of how BTC is changing into a part of mainstream monetary portfolios, typically by default.

Growth Driven by Strategy Holdings and Corporate BTC Accumulation

The most important contributor to NBIM’s elevated Bitcoin publicity is its stake in enterprise intelligence and company BTC treasury agency Strategy.

NBIM’s possession within the firm rose to 1.05% of its shares, valued at $1.18 billion on the finish of June, up from 0.72% ($514 million) on the finish of 2024. Strategy itself expanded its BTC holdings by 145,945 BTC within the first half of 2025, which added 3,340 BTC to NBIM’s oblique publicity over the identical interval.

Additional publicity got here from holdings in different public firms with sizeable Bitcoin reserves. Firms corresponding to Block, Coinbase, MARA, and Metaplanet have elevated or maintained important BTC balances, additional contributing to the upward development.

Lunde identified that per capita, NBIM’s Bitcoin publicity now quantities to roughly 1,387 Norwegian kroner, or about $138, for every Norwegian citizen.

Broader Market Context and Currency Considerations

Lunde emphasised that this rising oblique publicity aligns with a wider market sample: any investor with a diversified fairness portfolio right this moment is prone to have some publicity to Bitcoin via company holdings.

He expects this development to strengthen as extra firms allocate to BTC as a part of their treasury methods. “Odds are excessive that any index investor or broadly diversified investor at the moment holds a modest BTC publicity via proxies,” Lunde mentioned, including that the phenomenon is prone to speed up over time.

The report additionally positioned the fund’s Bitcoin publicity inside the context of BTC’s latest market efficiency. In US greenback phrases, BTC reached an all-time excessive of greater than $123,000 in July, up 11.9% from its January 20 stage.

However, beneficial properties are much less pronounced in different currencies, with BTC up just one.5% in opposition to the US greenback index and nonetheless under January highs in euros. According to Lunde, €105,600 stays a key resistance stage for BTC in euro phrases, highlighting the function of foreign money fluctuations in assessing Bitcoin’s value efficiency globally.

NBIM’s rising oblique stake in Bitcoin demonstrates how publicity to the asset class can increase organically inside massive, diversified portfolios. Whether pushed by deliberate allocation or as a byproduct of fairness investments, the development displays Bitcoin’s deepening presence in international monetary markets.

Featured picture created with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.