Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Last Friday’s US July Employment Situation launch has delivered the type of statistical jolt that not often reveals up exterior crises, forcing merchants to re-evaluate each the macro outlook and Bitcoin’s near-term path. Payrolls grew by simply 73,000, however the shock lay within the record-large detrimental revisions: May and June have been marked down by a mixed 258,000 jobs, slicing the three-month hiring common to 35,000 and erasing almost all the second-quarter’s reported momentum. The Bureau of Labor Statistics notes that revisions of that magnitude have been seen solely through the Covid collapse.

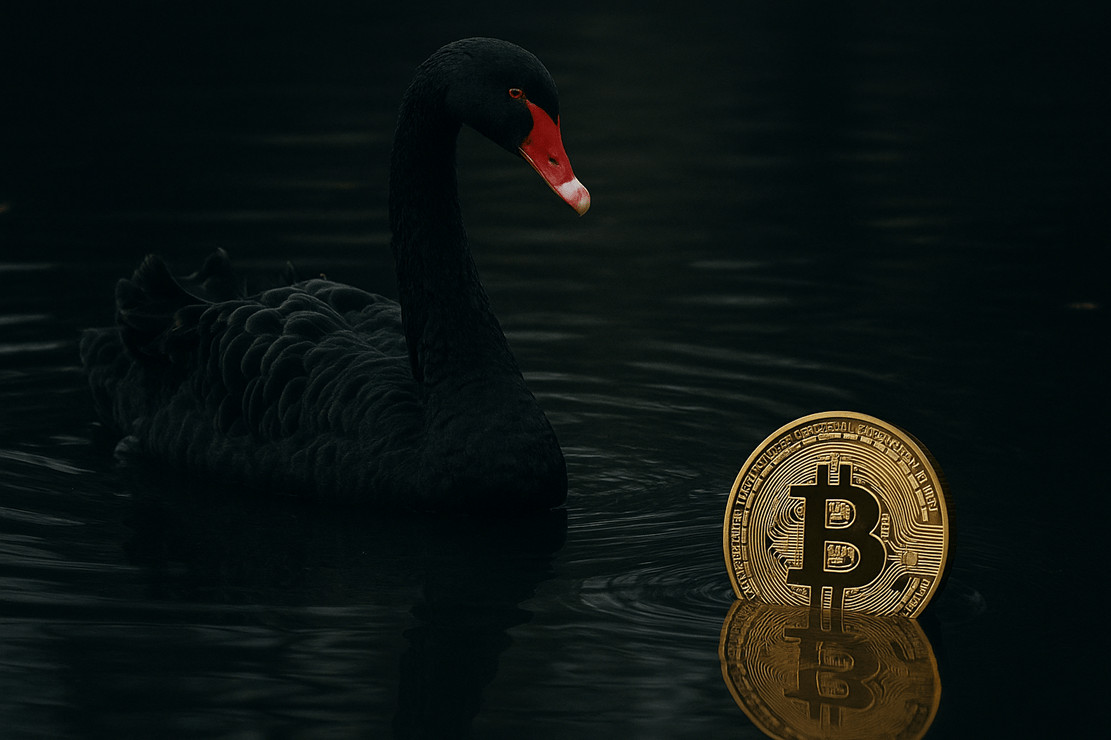

Is Bitcoin Really Facing A Black Swan Event?

Bloomberg Economics chief US economist Anna Wong wrote: “The downward revisions to May and June payrolls within the July jobs report represent a black swan occasion – a three-standard-deviation transfer with lower than a 0.2% probability of prevalence within the final 30 years. Adjusted for our estimate of the job overstatement from the Bureau of Labor Statistics’ birth-death mannequin, the three-month hiring tempo turns outright detrimental.” The knowledge, she wrote in a terminal word circulated Friday, “flipped the labor-market script” from re-acceleration to abrupt cooling.

Related Reading: Bitcoin Could See Another Crash To Fill This Imbalance Before Rally To $120,000

The market’s crypto voice on the difficulty has been Bitwise Europe’s head of analysis, André Dragosch, who spent the morning posting a string of warnings on X. First got here the information, ”According to Bloomberg chief economist Anna Wong, the newest payroll revisions have been a ‘black swan occasion’.Will most likely get even worse earlier than it will get higher…”, then the maxim, “Yes – dangerous for payrolls = good for bitcoin, not less than over the medium to long run.”

Minutes later he argued that deeper revisions may power emergency easing: “NOTE: There is a powerful case for a detrimental June jobs print after additional draw back revisions which may result in a 50 bps price reduce in September… Plan accordingly. #Bitcoin”

By mid-afternoon he pushed the purpose to its logical excessive: “ATTENTION: We are most likely only a single detrimental NFP print away from a big repricing in Fed price reduce expectations. US labor market & inflation knowledge surprises are nonetheless as dangerous as throughout Covid however merchants solely value in 2 cuts till Dec 2025… Printer is coming… ”

Interest-rate futures moved sharply in Dragosch’s course. On Wednesdays, the CME FedWatch Tool confirmed a 91 p.c chance of not less than one reduce on the 17–18 September FOMC assembly. Minneapolis Fed President Neel Kashkari acknowledged that “the actual underlying economic system is slowing,” whereas Governor Lisa Cook referred to as the scale of the revisions “regarding.”

Related Reading

Bitcoin’s value motion captured the tug-of-war between recession concern and liquidity hope. The flagship cryptocurrency slumped to $111,920 on 2 August, its lowest print since early July, instantly after the payroll launch and President Donald Trump’s subsequent firing of BLS Commissioner Erika McEntarfer. A tentative rebound towards $111,500 adopted as rate-cut odds ballooned this week. Yet, Bitcoin remained tethered to macro headlines moderately than its personal cycle.

Still, the primary clear signal of positioning for simpler coverage has emerged in fund flows. Spot Bitcoin ETFs recorded a internet $91.6 million influx on 7 August, snapping a four-day outflow streak that had drained greater than $380 million from the automobiles.

Whether Bloomberg’s and Dragosch’s black-swan framing proves prescient will rely upon the following few knowledge prints and the Fed’s tolerance for threat. For now the market is caught between these poles: one dangerous jobs quantity away from a full-blown coverage response, however yet another shock away from a broader risk-off spiral. The solely certainty, as Wong’s chance math and Dragosch’s full-throated alerts each suggest, is that the margin for error has evaporated.

At press time, BTC traded at $116,359.

Featured picture created with DALL.E, chart from TradingView.com