Bitcoin has seen “purchase the dip” mentions spike on social media after the worth crash, however Santiment warns this might be a contrarian sign.

Social Media Users Are Calling To Buy The Bitcoin Dip

In a brand new Insight submit, analytics agency Santiment has talked about how the market has been reacting to the newest plunge within the Bitcoin worth. “One of the primary issues we prefer to search for is an indication of shops exhibiting enthusiasm towards shopping for the dip,” notes Santiment.

The indicator cited by the analytics agency is the “Social Volume,” which measures the overall quantity of posts/messages/threads showing on the most important social media platforms that make distinctive mentions of a given time period or matter.

Santiment has filtered the Social Volume for Bitcoin-related key phrases and phrases pertaining to requires “purchase the dip.” Below is a chart exhibiting the pattern within the metric over the previous month.

As is seen within the graph, the Bitcoin Social Volume has spiked for these phrases, indicating that curiosity in shopping for the dip has surged amongst social media customers. At the present worth, dip-buying calls are at their highest in 25 days.

While this might sound like a sign {that a} rebound could also be coming quickly for the cryptocurrency, historical past has had many examples of the opposite. “Prices sometimes transfer the wrong way of the group’s expectations,” explains the analytics agency. Considering this, the dip-buying hype might really be an indication that extra ache could also be forward for BTC earlier than the underside can really be in.

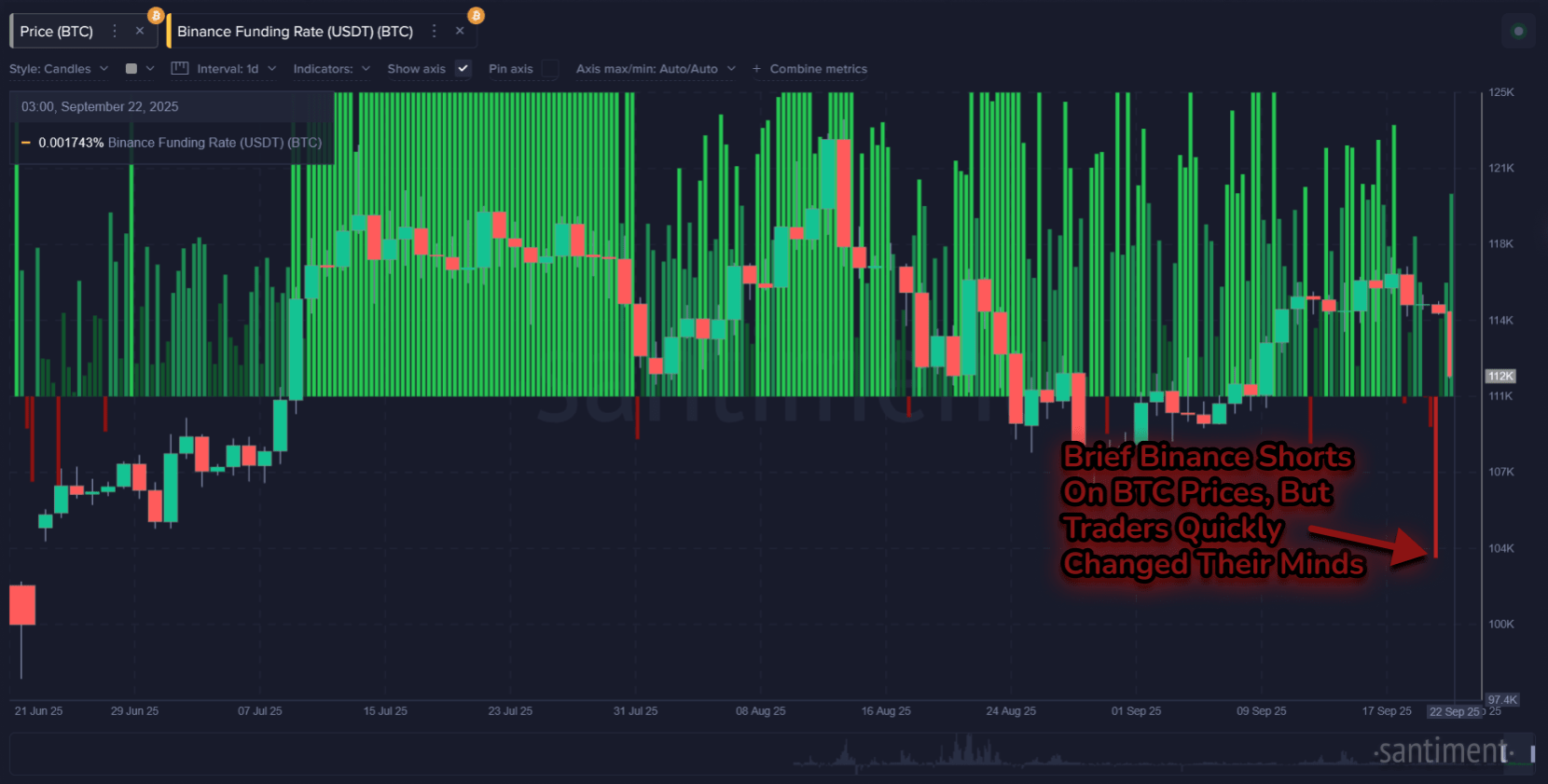

“Once the group stops feeling optimistic, they usually start to promote their luggage at a loss, that is sometimes the time to strike along with your dip buys,” says Santiment. Another gauge for market sentiment is thru the Binance Funding Rate, which is a metric that retains monitor of the periodic price that derivatives merchants are exchanging between one another on the biggest cryptocurrency trade by buying and selling quantity.

The indicator turned sharp purple simply forward of the newest plummet within the Bitcoin worth, indicating that brief positions turned dominant on Binance. After the decline, nevertheless, merchants modified their tune because the metric switched again to being inexperienced.

This pattern would counsel that traders are hoping Bitcoin would rebound quickly. “Ideally, for a notable worth bounce to happen, we have to see a sustained interval of shorts outpacing longs,” notes the analytics agency. As such, this might be one other indicator to control, as a flip into the damaging for an prolonged part might pave the best way towards a backside.

BTC Price

Bitcoin has been unable to make restoration from its crash as far as its worth continues to commerce round $112,700.