Data exhibits the Bitcoin traders on derivatives exchanges nonetheless lean bearish towards the cryptocurrency even after the latest worth restoration.

Bitcoin Short Positions Still Outweigh The Long Ones

In a brand new publish on X, on-chain analytics agency Glassnode has talked about how Bitcoin market sentiment is wanting from the lens of the derivatives market proper now. The indicator shared by Glassnode is the “Long/Short Bias,” which measures the web quantity of positions that enormous merchants have at present opened.

When the worth of this indicator is optimistic, it means the lengthy positions outnumber the quick ones. Such a development implies nearly all of the merchants maintain a bullish sentiment. On the opposite hand, the metric being underneath the zero mark implies extra BTC positions are betting on a bearish end result for the cryptocurrency.

Now, right here is the chart shared by the analytics agency that exhibits the development within the Bitcoin Long/Short Bias over the previous month:

As displayed within the above graph, the Bitcoin Long/Short Bias has been adverse for some time now, suggesting quick positions have been the extra dominant facet of the market.

Interestingly, this hasn’t modified regardless of the worth restoration that BTC has seen because the begin of this month. At current, quick positions nonetheless outweigh bullish bets by 485 BTC (value round $56.2 million).

Historically, Bitcoin and different cryptocurrencies have tended to maneuver within the route that goes opposite to the group’s expectation, so the dominance of bearish sentiment within the derivatives market will not be such a nasty factor.

In one other X thread, Glassnode has mentioned about some metrics associated to the Bitcoin Options market. First of those is the Implied Volatility (IV), which measures the longer term volatility expectation of the Options merchants.

In specific, the model of the metric that’s of curiosity right here is the “At-The-Money” (ATM) one, which solely exhibits this expectation for the merchants with a strike worth near the present BTC spot worth.

Below is a chart that exhibits the development on this indicator throughout the foremost tenors for Bitcoin over the previous few weeks.

From the graph, it’s obvious that the 1-week Bitcoin ATM IV rose forward of the Federal Open Market Committee (FOMC) assembly, however then plunged after the Fed introduced its choice. Longer expiry timeframes displayed no specific response to the occasion.

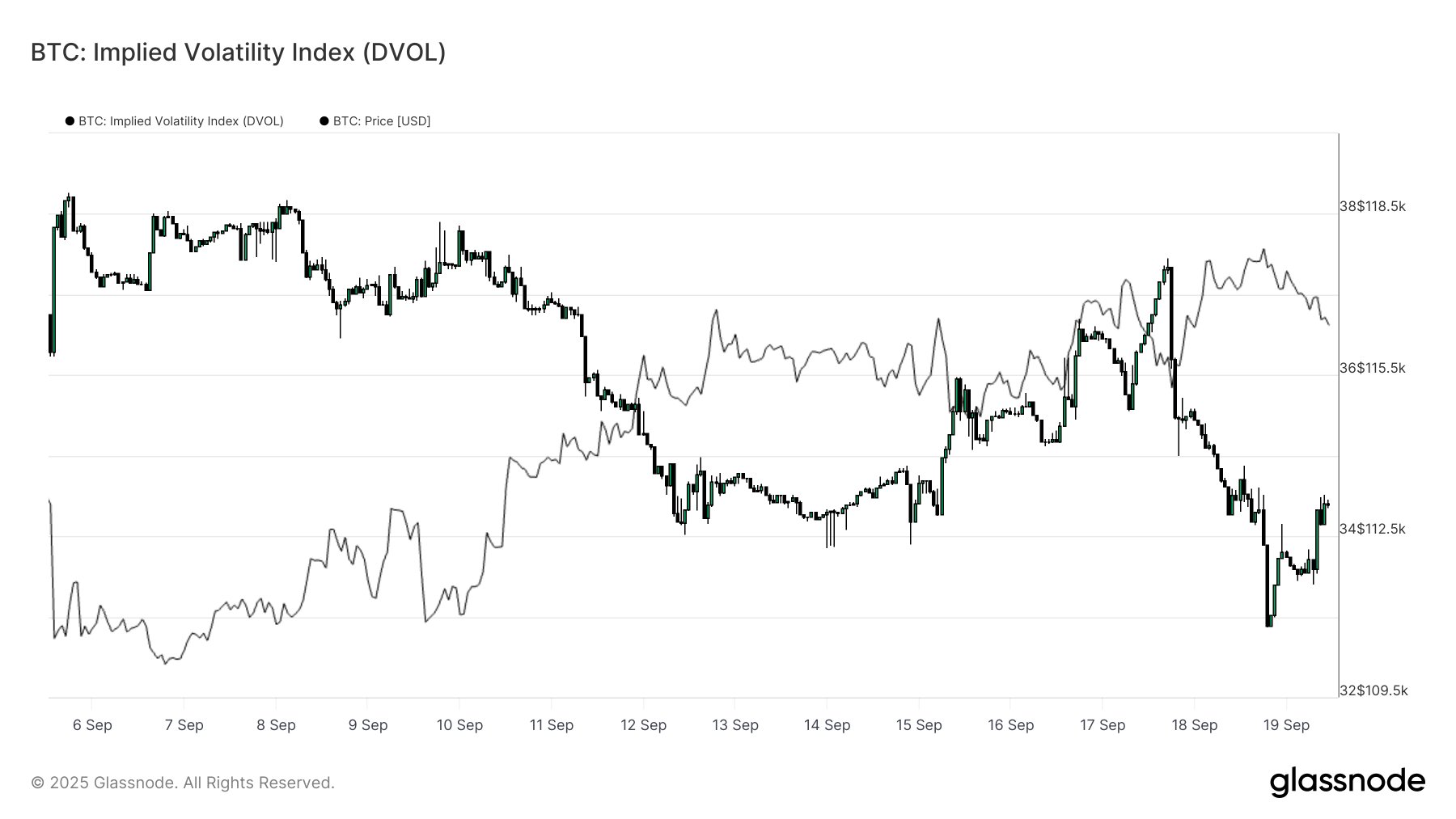

Another gauge for Options market volatility expectations is the IV Index (DVOL), which aggregates the IV throughout strike costs and tenors.

“Post-FOMC, DVOL dropped again, confirming the market will not be pricing any sharp transfer within the close to time period,” notes Glassnode.

BTC Price

Bitcoin made restoration towards $117,900 earlier, but it surely appears the coin has confronted a retrace as its worth has dropped again to $116,000.