Bitcoin is again within the highlight after stories confirmed that cash untouched since 2012 have been moved for the primary time.

Related Reading

The reactivation of an previous pockets got here at a second when the market is already buzzing with sturdy ETF inflows and report ranges of stablecoin liquidity.

Wallet Reactivates After 13 Years

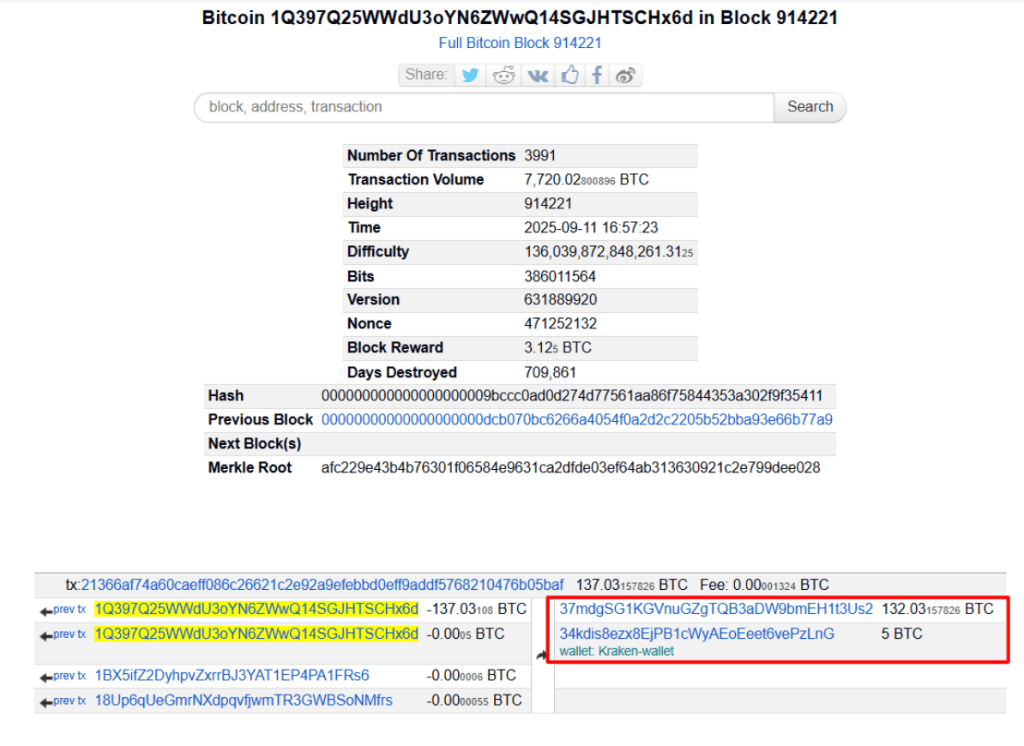

According to Onchain Lens, the deal with that first obtained cash on November 26, 2012, moved 132.03 BTC in a single transaction.

The switch was value about $15 million at present costs. The similar pockets additionally despatched 5 BTC to the Kraken trade. After these strikes, it nonetheless holds 308 BTC — a stash now valued at almost $35 million.

In whole, the deal with as soon as managed 444 BTC, which the report locations at greater than $50 million mixed.

A dormant whale woke-up after 13 years, moved 132.03 $BTC ($15.06M) to a brand new deal with and depositing 5 $BTC into #Kraken.

The pockets nonetheless holds 307.79 $BTC ($35M). It has obtained these $BTC for simply $5,437 at $12.22https://t.co/mhCNYQs7cA pic.twitter.com/L0ltIwu6Oe

— Onchain Lens (@OnchainLens) September 11, 2025

Early Holder Made A Tiny Bet That Paid Off

Based on stories, the cash have been initially purchased when Bitcoin traded at about $12.22 per coin. The pockets’s whole buy price was solely $5,435.

That authentic outlay has became huge good points. The present math reveals a revenue within the ballpark of $15.60 million on that small preliminary purchase. Simple numbers like that assist clarify why tales about previous wallets get consideration.

Bitcoin Price And Market Momentum

Bitcoin has pulled again above the $116,000 mark. Data from Coingecko present BTC buying and selling at $116,083, a each day transfer of 0.25% and up 3% over the previous week.

The market nonetheless remembers August 14, 2025, when BTC hit an all-time excessive of $124,450. Those value swings are a part of the backdrop for why a whale shifting cash attracts additional curiosity now.

Institutional Flows Pick Up

Data reveals that Bitcoin spot ETFs recorded $757 million in inflows on Wednesday. That is the most important single-day quantity since July 17 and extends a three-day streak of optimistic flows.

The regular inflows recommend larger gamers are including publicity, or at the least reallocating capital into the market.

Total crypto market cap at $3.95 trillion on the each day chart: TradingView

Stablecoin Reserves Hit Records

Meanwhile, stories from CryptoQuant point out Binance noticed its largest internet stablecoin influx of the 12 months on Monday, a bit of over $6 billion.

Binance’s stablecoin reserves are reported to be close to $40 billion, whereas combination stablecoin holdings throughout exchanges hit about $70 billion final week.

Related Reading

New Layer Of Intrigue

The sudden motion of cash untouched for greater than a decade has added a brand new layer of intrigue to Bitcoin’s newest rally.

With the asset holding above $116,000, ETFs drawing lots of of tens of millions in inflows, and report stablecoin balances sitting on exchanges, the market is flush with liquidity and a focus.

Whether this pockets exercise alerts profit-taking, repositioning, or one thing else completely, it highlights the enduring energy of early bets on Bitcoin and the continued affect of long-term holders on right now’s market.

Featured picture from Unsplash, chart from TradingView